In our previous analyses, Visa uncovered key variations in the travellers that Melbourne and Suzuka attract to their major motor races – in terms of who are travelling to each race, and how their travel footprints evolve beyond the race. As merchants and issuers look to benefit from the uptick in tourism, it is as important to know what merchants can benefit most, and how they can tangibly do so.

The data uncovered two key trends. Large retailers and merchants are not the only ones to benefit from the influx of travel during motor racing, as data from Melbourne and Suzuka indicate that small and medium-sized businesses (SMBs) are gaining a growing foothold on travel spending. Contactless payments also continue to drive travel spending, with data in Melbourne and Suzuka a positive sign for merchants and tourism in Japan as a whole.

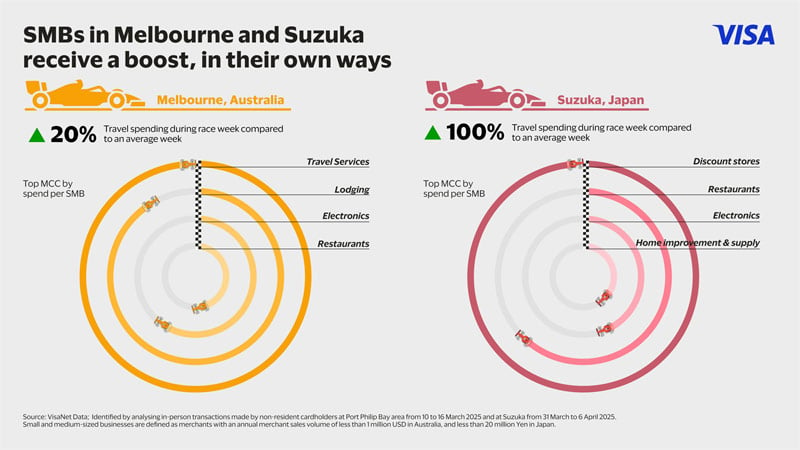

SMBs in Melbourne and Suzuka receive a boost, in their own ways

The prime location of the Albert Park circuit coincided with an expected surge in traveller footfall and spending, as previously analysed by Visa. But Suzuka’s location further away from the city did not dampen travel spending, especially on SMBs¹, who appear to be acting quickly to capture the travel boom.

In Melbourne, Visa’s data found travel spending on SMBs² to be about 20% higher than an average week³, with SMBs on average receiving about US$1,000 in travel spending each during the week. In fact, approximately 40% of all travel receipts went to SMBs, showing that despite the presence of large retail chains and established merchants, SMBs are gaining a healthy share of the tourism pie sparked by motor racing. A major growth opportunity is spending by overseas travellers, which grew 40% than from an average week especially for merchants in retail, electronics, and dining⁴.

Meanwhile in Suzuka, more SMBs are setting up shop in the vicinity of the circuit to capture the travel surge during the racing season, as the number of SMBs in the area has steadily doubled from 2022⁵. While SMBs account for just about 25% of all traveller spending, lower than in Melbourne, spending by overseas travellers has doubled from the race week last year⁶, a faster rate than in Melbourne. They are spending on a variety of products offered by SMBs too – from sampling local cuisine at restaurants, shopping for gifts at local retailers, to even electronics.

In both Melbourne and Suzuka, post-race travel uncovered by our previous analysis is also bringing a boost to SMBs. The concentration of post-race travel around Melbourne and the state of Victoria is coinciding with a surge in spending in surrounding cities. Meanwhile, Japan’s diverse post-race travel patterns see SMB spending climb across the country, especially in popular cities like Okinawa (~30%), Kyoto (~20%), and Osaka (~15%)⁷.

What it means: Visa’s data suggests that it is not only larger retailers and enterprises that gain from the travel buzz created by motor racing. SMBs, even with fewer resources, can benefit by investing smartly in their product mix and marketing ahead of time. Other than simply locating themselves strategically at the races, it is crucial they show what makes their offerings unique and not available elsewhere, such as handmade crafts and products, local produce, or distinctive local cuisines.

Second, SMBs must cater to an increasingly cashless world to be able to convert window shoppers into customers. This means offering a range of payment options and ensuring that overseas travellers know their cards, either physical or provisioned onto their mobile phones, are readily accepted. Issuers and acquirers can also give SMBs support by offering easy-to-use marketing collaterals or offering efficient ways to accept contactless methods in the long term.

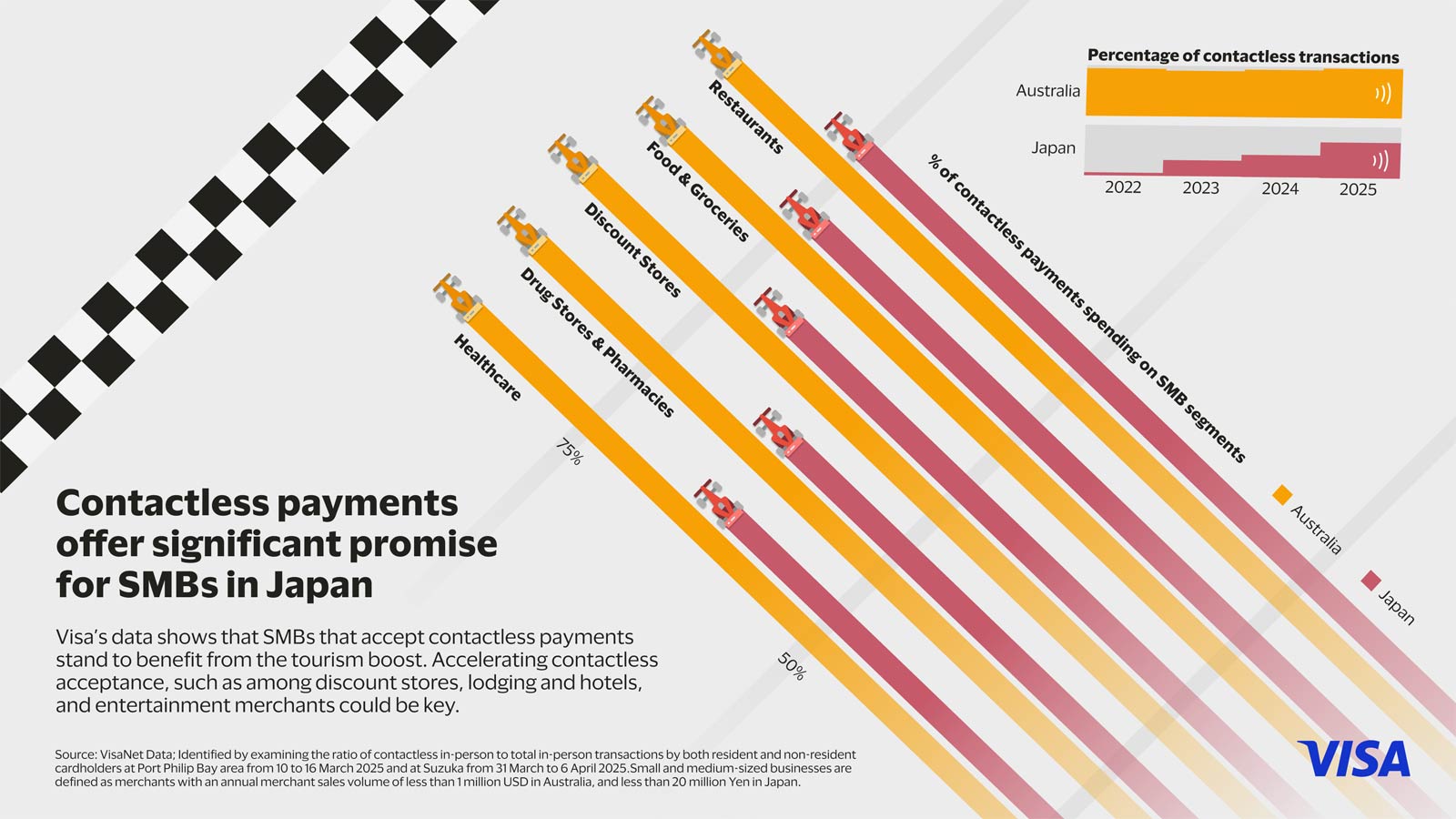

Contactless payments offer significant promise for SMBs in Japan

Beyond the broad impact to SMBs, Visa’s data also uncovers what SMBs can tangibly do to capture a larger share of the travel pie. An important lever is the adoption of contactless payments, as it continues to drive and shape the way people pay on their travels.

The ubiquity of contactless payments and their positive impact on SMBs in Melbourne during the race week offers signs of promise for SMBs in Japan. According to Visa’s data, contactless payments formed about 90% of all traveller spending in the Port Philip Bay area during the week of the race⁸ and crucially, SMBs that accept contactless payments saw traveller spending surge approximately 20% during the race week, compared to an average week⁹. It continues a across Visa’s travel insights, from the Sakura season to the Singapore Night Race to Japan’s ski season this year.

These insights coincide with an upward trajectory for contactless payments in Japan during the race week in Suzuka. According to Visa’s data, contactless payments usage among travellers appears to be at an inflection – while it accounted for just over 25% of all travel spending by dollars during the race week in Suzuka, this proportion has doubled from 2023 and a far cry from just 1% in 2022.

Most tellingly, contactless payments already account for around 70% of all transactions in Suzuka during the race week. In short, contactless payments are becoming a norm for travellers on their journeys.

What it means: Visa’s data shows that SMBs who adopt contactless payments stand to benefit the most from not just travel spending during motor racing events, but from travel as it continues to hit new heights. Comparing data in Suzuka to Melbourne, we can see similar use of contactless payments in restaurants (~80%) and food and grocery stores (~80%) in Melbourne and Suzuka, but specific segments in Suzuka have room for growth, such as discount stores, lodging, and entertainment outlets.

There is value in issuers, authorities, and even municipal governments in accelerating the pace of education, advocacy, and acceptance support among merchants, such as Visa’s partnership with the Osaka Prefecture in 2023, which is modernising payment acceptance among merchants of all sizes in the prefecture and growing their tourism appeal.

Visa Consulting and Analytics (VCA) harnesses Visa’s payments expertise and proprietary analytics to deliver insights that drive better business outcomes and improve customer journeys. We help clients formulate strategies to capture the biggest payment opportunities, optimise portfolios, and execute on digital more effectively.

Learn how you can work with VCA here.

_________________________________________________

¹ Small and medium-sized businesses in Suzuka are defined as merchants with an annual merchant sales volume of less than 20 million yen.

² Small and medium-sized businesses in Melbourne are defined as merchants with an annual merchant sales volume of less than 1 million USD.

³ Identified by comparing in-person transactions made by both resident and non-resident cardholders with SMBs at Port Philip Bay area during two distinct periods: 10 March 2025 to 16 March 2025, and 11 March 2024 to 9 March 2025. For resident cardholders, only those who had not made any transactions at Port Philip Bay area in the previous three months were included.

⁴ Identified by comparing in-person transactions made by non-resident cardholders with SMBs at Port Philip Bay area during two distinct periods: 10 March 2025 to16 March 2025, and 11 March 2024 to 9 March 2025.

⁵ Identified by comparing the number of SMBs at Suzuka during two distinct periods: 31 March 2025 to 6 April 2025, and 3 October 2022 to 9 October 2022.

⁶ Identified by comparing in-person transactions made by non-resident cardholders with SMBs at Suzuka during two distinct periods: 31 March 2025 to 6 April 2025, and 1 April 2024 to 7 April 2024.

⁷ Identified by comparing in-person transactions made by non-resident cardholders at Okinawa, Yokkaichi, Kyoto, Osaka during two distinct periods: 31 March 2025 to 6 April 2025, and 1 April 2024 to 7 April 2024.

⁸ Identified by examining the ratio of contactless in-person to total in-person transactions by both resident and non-resident cardholders at Port Philip Bay area between 10 March 2025 to 16 March 2025. For resident cardholders, only those who had not made any transactions at Port Philip Bay area in the previous three months were included.

⁹ Identified by comparing in-person transactions made by non-resident cardholders with SMBs which enabled contactless payment at Port Philip Bay area during two distinct periods: 10 March 2025 to16 March 2025, and 11 March 2024 to 9 March 2025.