The annual motor racing calendar brings a flurry of fan excitement and travel. The beauty is that no two races are the same: different cities, tracks, and the unique drama that comes with the stakes on offer.

The global nature of motor racing makes it a source of rich insights on travel and payments: How does motor racing inspire travel? Who travels and how do they spend their budgets? How should issuers and merchants capitalise on the boost in tourism?

To answer these questions, Visa dove into the data for one, but two of Asia’s biggest races – Melbourne and Suzuka – to compare variations in travel and consumer spending.

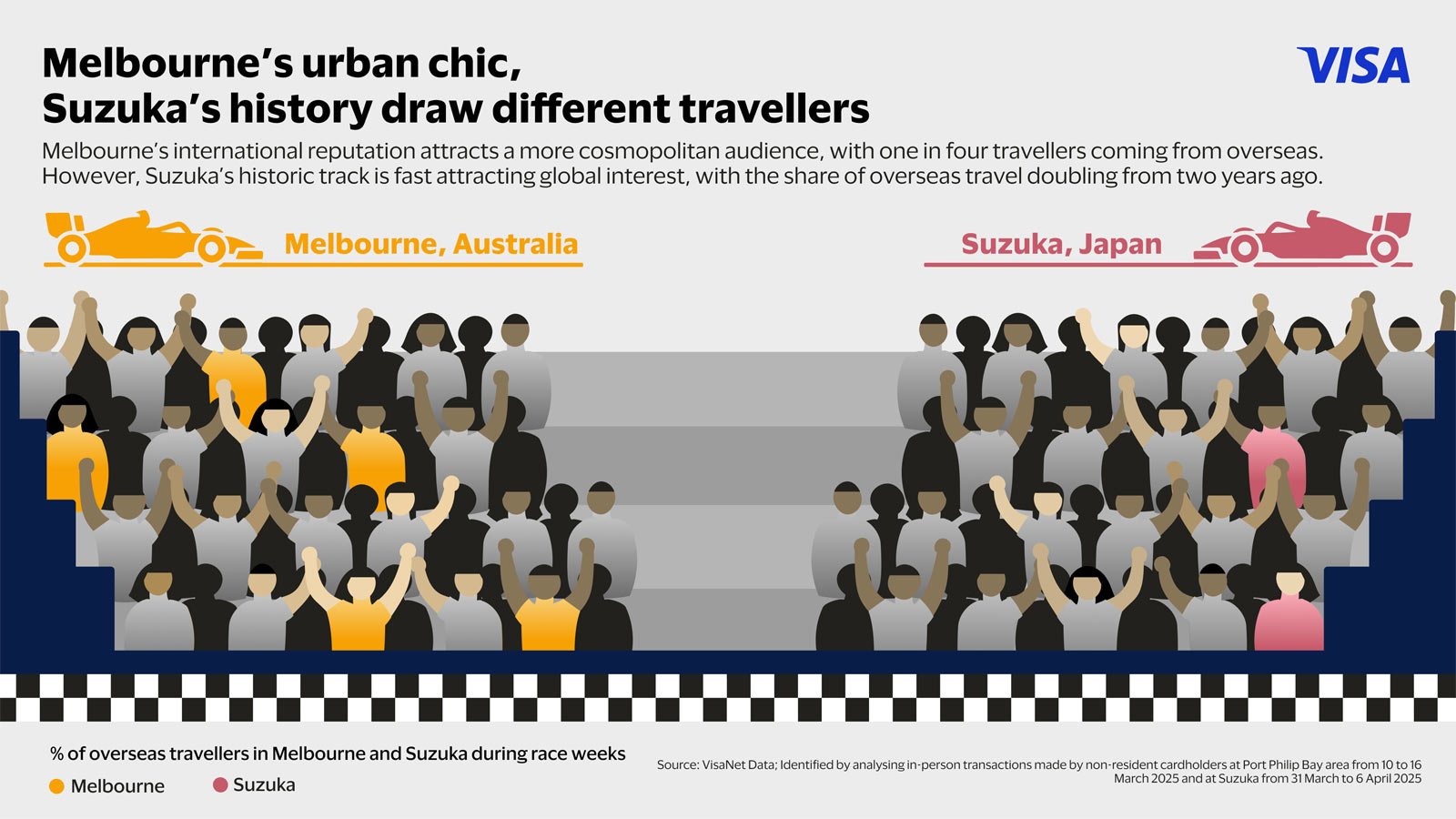

Melbourne’s urban chic, Suzuka’s history draw different travellers

The Melbourne and Suzuka races are both in Asia Pacific, but they have distinct identities. Melbourne’s Albert Park circuit is at the heart of the city and is built 30 years after Suzuka, one of the oldest circuits in the world to the south of Nagoya.

While both races created a lift to tourism and travel spending, a closer look at data reveals differences in travel demographics, as well as how travellers behaved during and after the week of the race.

For instance, the Port Philip Bay area around the Melbourne circuit garnered an about 20% lift in travel and spending in the week of the race compared to an average week¹, with its city centre location a draw to travellers. Suzuka, located a distance from Nagoya, did not see a noticable surge in travel but it did inspire deliberate spending by fans at home and abroad, as travel spending in Suzuka grew about 25% from an average week².

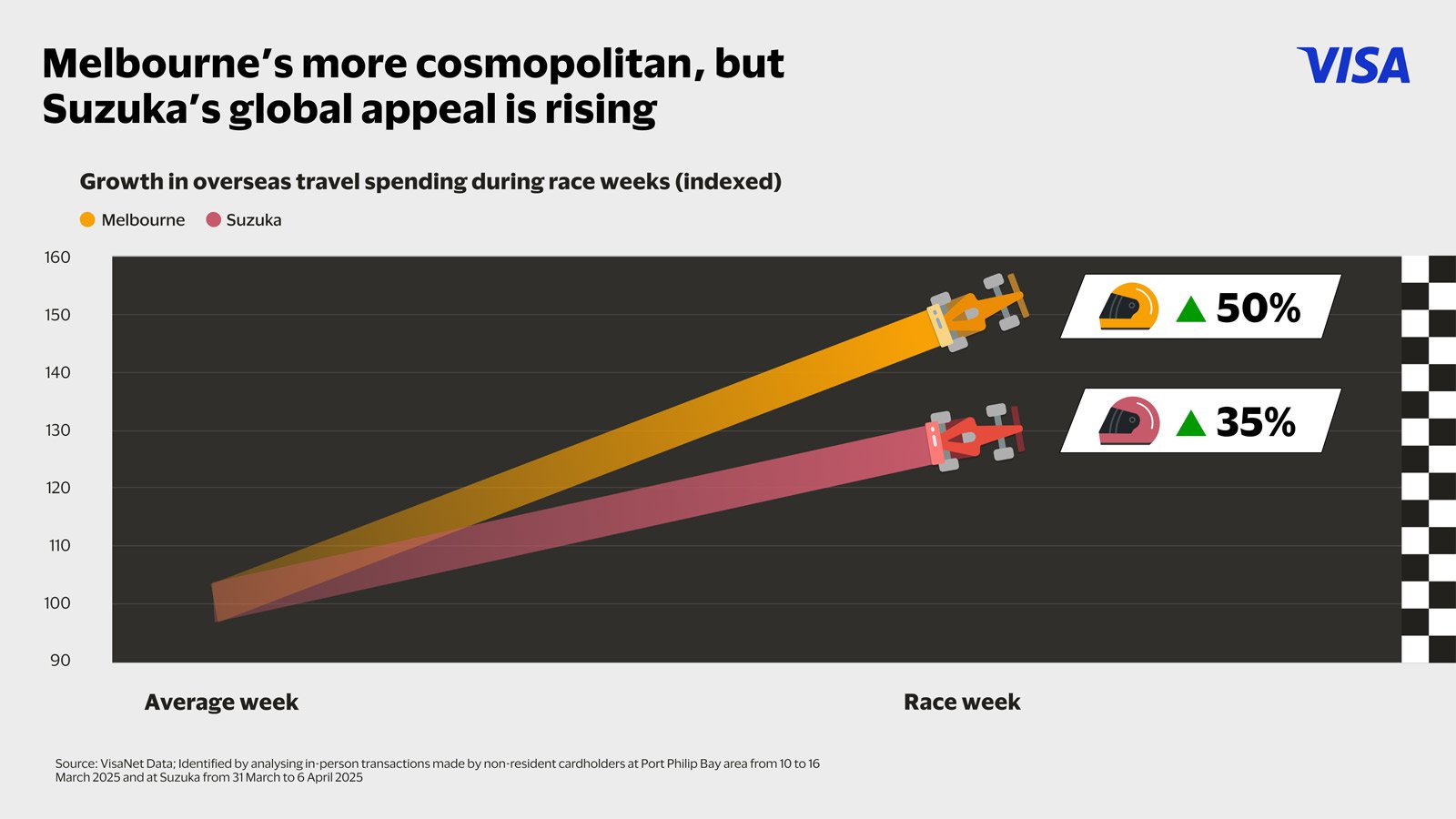

Melbourne's more cosmopolitan, but Suzuka’s global appeal is rising

When it comes to the profile of travellers, Visa’s data shows that Melbourne’s international reputation attracts a more cosmopolitan audience. Overseas travellers represented about one in four of all travellers in the race week and compared to an average week, the Port Philip area ushered in approximately 40% more overseas travel and 50% more overseas traveller spending³.

So, who exactly are travelling and spending in Melbourne? From the data, neighbours New Zealand sit atop both travel and spending, followed by the United Kingdom and the United States. Travellers from Europe and Mainland China are also big fans, with Ireland, Mainland China, Germany, and France among the top travellers and spenders in the race week.

Meanwhile, Suzuka’s historic track is a source of pride for Japan. Approximately nine in ten travellers during the race week come from within the country. But the growing global presence of formula racing is making Suzuka a must-see for racing fans worldwide. In fact, the share of overseas visitors has doubled from two years ago, while their spending during the week of the race skyrocketed by approximately 200% across the same period⁴.

This is also seen in the growing diversity of overseas travellers to Suzuka: while most travellers came from the United States (US), Hong Kong SAR, and Mainland China, the race also draws fans as far as Italy, the United Kingdom, France, and Germany – where motor racing is embedded in the culture. In terms of overseas travel spending, Luxembourgian travellers surprisingly ranked second just behind the US, while travellers from the United Kingdom, France, and Netherlands also made the top ten.

What it means: The travel buzz that the races create around the Melbourne and Suzuka circuits could be a sign for merchants to ramp up their promotional efforts, especially in and around the race weeks. They should also pay attention where travellers are coming from to position their offerings strategically to different tastes and preferences.

For instance, merchants in Melbourne market in different languages, especially English, Mandarin, German, and French to convert passing shoppers into new customers, while restaurants can offer specialised dining menus to specific tastebuds and what they want to discover. Meanwhile, merchants in Suzuka could add a European twist to their dining menus or shelves as motor racing fever from the continent spreads to the region.

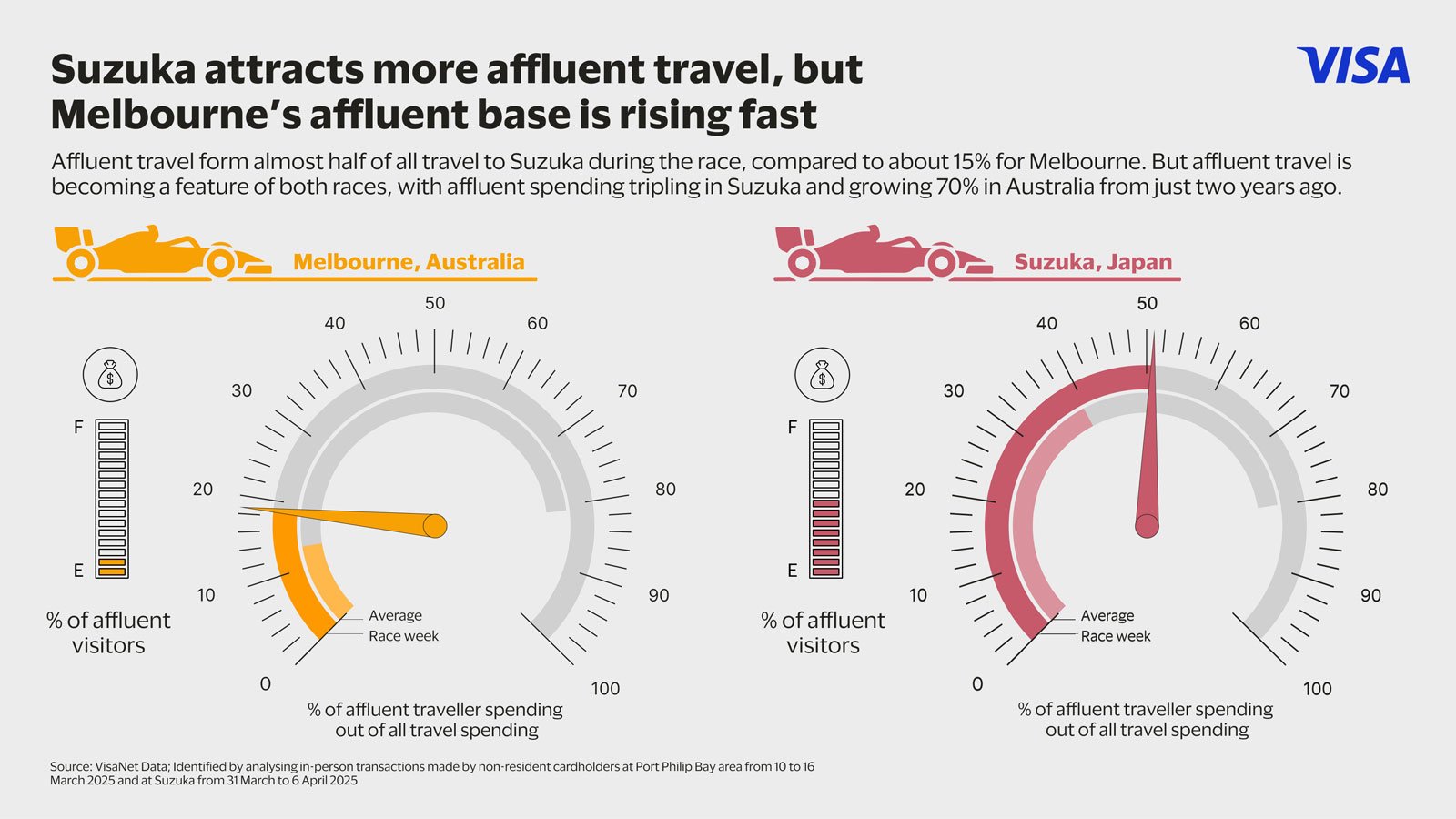

Suzuka attracts more affluent travel, but Melbourne’s affluent appeal is rising fast

Suzuka and Melbourne also attract different types of travellers in terms of their economic profiles. Affluent travellers form almost half (~45%) of all travel to Suzuka during the race, perhaps due to the location of the track which requires more complex travel arrangements. In fact, affluent travel is an area of growth for Suzuka, with affluent spending representing more than half of all spending during the race week. In addition, the number of overseas affluent travellers to Suzuka during the race has grown by almost 70% while their spending has approximately tripled from just two years ago⁵.

Meanwhile, affluent travellers form just about 15% of all visitors and spending during race week in Melbourne. However, like Suzuka, affluent travel and spending from overseas is growing fast at about 90% and 70% higher than just two years ago⁶, a sign of the increasing allure of the race for affluent fans and travellers.

What it means: A growing affluent traveller base is an opportunity for merchants offering luxury products or specialised goods and services to promote themselves in the racing season. This could mean setting up retail stores near the races, or consider creative retail strategies such as pop-up exhibitions could complement their existing marketing or consumer attractions already in place during the racing season.

In addition, targeted promotional efforts with issuers leading up to the race can be key in ensuring that their brands and products stay top of mind, such as targeted promotions offered within issuers’ banking ecosystems during the month of the race.

Visa Consulting and Analytics (VCA) harnesses Visa’s payments expertise and proprietary analytics to deliver insights that drive better business outcomes and improve customer journeys. We help clients formulate strategies to capture the biggest payment opportunities, optimise portfolios, and execute on digital more effectively.

Learn how you can work with VCA here.

_________________________________________________

¹ Identified by comparing in-person transactions made by both resident and non-resident cardholders at Port Philip Bay area during two distinct periods: 10 March 2025 to 16 March 2025, and 11 March 2024 to 9 March 2025. For resident cardholders, only those who had not made any transactions at Port Philip Bay area in the previous three months were included.

2 Identified by comparing in-person transactions made by both resident and non-resident cardholders at Suzuka during two distinct periods: 31 March 2025 to 6 April 2025, and 8 April 2024 to 30 March 2025. For resident cardholders, only those who had not made any transactions at Suzuka in the previous three months were included.

³ Identified by comparing in-person transactions made by non-resident cardholders at Port Philip Bay area during two distinct periods: 10 March 2025 to 16 March 2025, and 11 March 2024 to 9 March 2025

⁴ Identified by comparing non-resident cardholders who made in-person transactions at Suzuka during two distinct periods: 31 March 2025 to 6 April 2025, and 18 September 2023 to 24 September 2023

⁵ Identified by comparing in-person transactions made by affluent non-resident cardholders at Suzuka during two distinct periods: 31 March 2025 to 6 April 2025, and 18 September 2023 to 24 September 2023

⁶ Identified by comparing in-person transactions by affluent non-resident cardholders at Suzuka during two distinct periods: 31 March 2025 to 6 April 2025, and 18 September 2023 to 24 September 2023