Visa’s recent comparisons of the Melbourne and Suzuka motor races found important variations in the profiles of travellers to each race, showing that no two races are the same in terms of what travel sparked by motor racing means to issuers and merchants.

But Visa’s data also shows that increased tourism during races deliver additional benefits beyond the races, first being increased nighttime spending as travellers indulge in food and entertainment over the race weekends, and a surge in post-race tourism that benefits not only Melbourne and Suzuka, but the rest of the countries.

Learn more about what these trends mean for you, as Visa’s data points you in the correct direction to capitalise on the tourism boost that comes from motor racing.

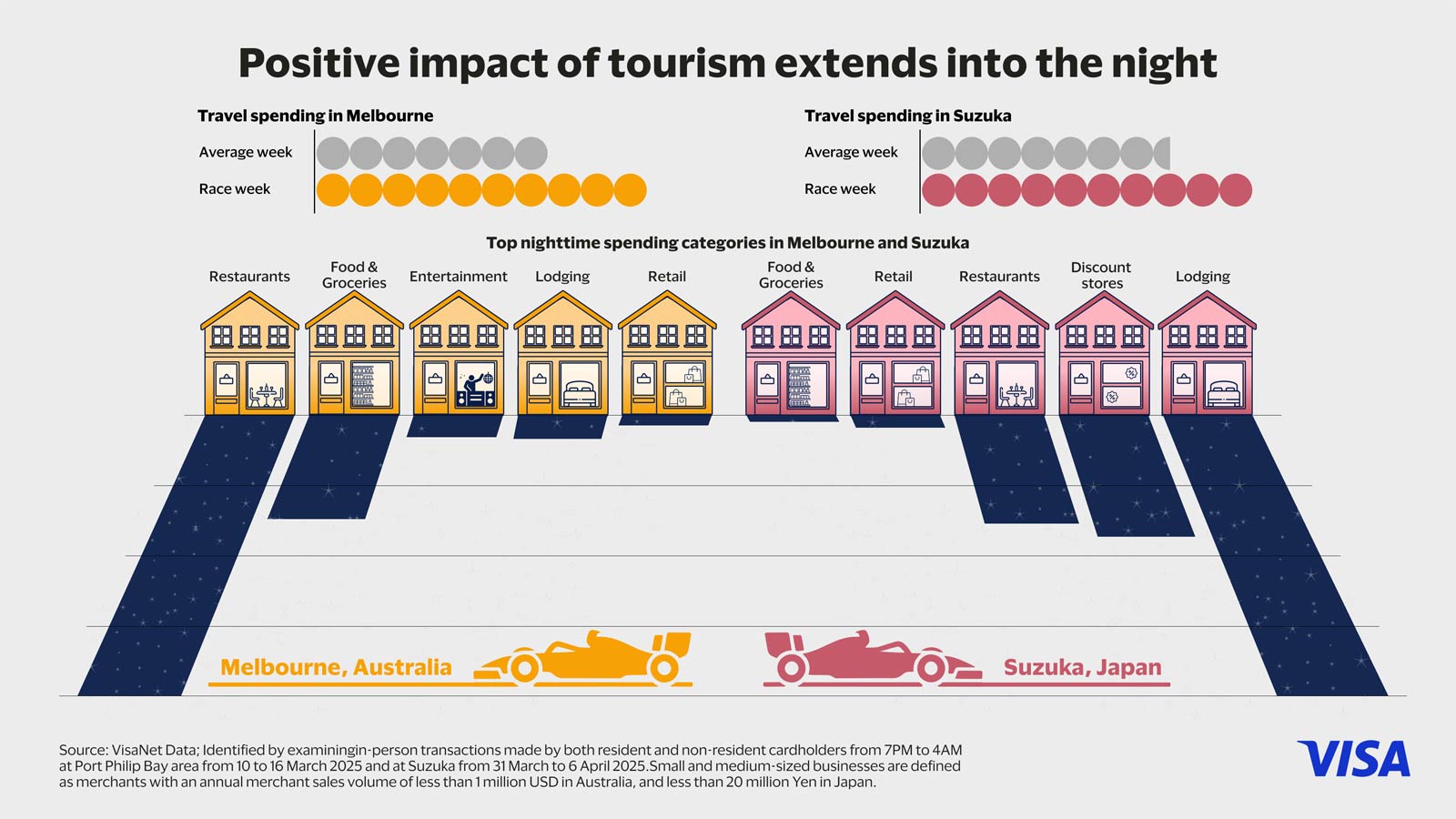

Positive impact of tourism extends into the night

What is music to the ears for merchants is a clear lift in nighttime spending (after 7pm local time) in the race week. Compared to an average week, nighttime spending in the Port Philip Bay area and around the Suzuka racetrack grew 40%¹ and 35%² respectively.

Dining and retail therapy are top of mind for travellers after the race days wind down. In the Port Philip Bay area in Melbourne, travel spending at department stores nearly doubled from an average week, while restaurants, food and groceries, and electronics retailers also saw a lift in traveller spending³.

Similar trends were seen in Suzuka, with discount retailers seeing the most noticeable boost in traveller spending, showing how like in Melbourne, travellers to the race were also looking to spend on travel essentials or perhaps gifts for their loved ones.

Victoria accounts for bulk of post-race travel in Melbourne, but travellers venture across Japan after Suzuka

A deeper dive into Melbourne and Suzuka reveals key differences in how travellers explore the rest of the country after the race. After the chequered flag in Melbourne, over one in four overseas travellers stayed within the vicinity, with about 10% remaining in the city⁴⁵.

Among those that ventured further, their footprints were largely within the state of Victoria, with the wine region of Yarra Valley a hotspot, as well as Wyndham, Whitehorse, Stonnington, and Glen Eira. The geographically concentrated pattern of travel can also be seen in how approximately 5% of travellers went to metropolitan cities like Sydney, which is over 800 kilometres away.

On the flipside, post-race travel in Suzuka is geographically diverse, as overseas travellers seemed intent on seeing all of Japan’s culture and urban attractions. Based on Visa’s data, Okinawa was surprisingly the most visited city after the races, representing about 20% of overseas travel despite being over 1,200 kilometres away from Suzuka – perhaps with the Sakura season top of travellers’ minds. Other major cities like Osaka (~10%) and Kyoto (~5%) to the west of Suzuka were also popular as travellers sought to visit their famous sights and sounds⁶.

For Suzuka and Melbourne, what overseas travellers spent most on after the race showed similarities, with lodging, restaurants, food and groceries, and retail the top categories.

What it means: Visa’s findings in Melbourne and Suzuka continue a thread from past analyses of tourism in Asia Pacific. Major sporting events like motor races can deliver widespread benefits beyond their immediate surroundings.

From the data, merchants in Victoria and those in travel hotspots across Japan are well-placed to benefit from a post-race tourism boost. Hotels, inns, and even onsens (hot springs) in popular post-race destinations should ramp up their marketing efforts in the months leading to the races, promoting themselves as ideal destinations for travellers to discover the country’s sights and sounds after the races.

Armed with Visa’s insights on traveller profiles and their travel patterns after the races, merchants and issuers are equipped to invest efficiently in the right areas to capture a larger share of travel footfall and spending. Issuers also play a big role in amplifying the post-race travel boom, such as through merchant and destination promotions tailored to different traveller segments through their own marketing channels.

Visa Consulting and Analytics (VCA) harnesses Visa’s payments expertise and proprietary analytics to deliver insights that drive better business outcomes and improve customer journeys. We help clients formulate strategies to capture the biggest payment opportunities, optimise portfolios, and execute on digital more effectively.

Learn how you can work with VCA here.

_________________________________________________

¹ Identified by comparing in-person transactions made by both resident and non-resident cardholders from 7PM to 4AM at Port Philip Bay area during two distinct periods: 10 March 2025 to 16 March 2025. For resident cardholders, only those who had not made any transactions at Port Philip Bay area in the previous three months were included.

² Identified by comparing in-person transactions made by both resident and non-resident cardholders from 7PM to 4AM at Suzuka during two distinct periods: 31 March 2025 to 6 April 2025, and 8 April 2024 to 30 March 2025. For resident cardholders, only those who had not made any transactions at Suzuka in the previous three months were included.

³ Identified by comparing in-person transactions made by both resident and non-resident cardholders from 7PM to 4AM at Port Philip Bay area during two distinct periods: 10 March 2025 to 16 March 2025, and 11 March 2024 to 9 March 2025. For resident cardholders, only those who had not made any transactions at Port Philip Bay area in the previous three months were included.

⁴ Identified by examining the non-resident cardholders who made in-person transactions in Port Philip Bay area during the race week, and made in-person transactions in Australia following the final race day until their departure from Australia (up to a maximum of one month after the race day in Port Philip Bay area)

⁵ City refers to Melbourne City itself while cities within the vicinity of Melbourne include: Boroondara, Brimbank, Cardinia, Casey, Darebin, Dandenong, Frankston, Glen Eira, Hobsons Bay, Knox, Maribyrnong, Maroondah, Melton, Monash, Moreland, Morning Peninsula, Nillumbik, Stonnington, Sunbury, Whitehorse, Whittlesea, Wyndham, Yarra

⁶ Identified by examining the non-resident cardholders who made in-person transactions in Suzuka during the race week, and made in-person transactions in Japan following the final race day until their departure from Japan (up to a maximum of one week after the race day in Suzuka)