The ski season is back and bigger than ever in Japan, with Visa data showcasing the growing tourism and spending boost it delivers to Japan's ski resorts and other cities across the country as skiing catalyses travel and traveller spending in the winter months.

Amid the tourism boost, a recurring theme uncovered in Visa’s travel spending data has been the growing prominence of contactless payments in driving travel spending, as travellers want easier, convenient, and streamlined payments that let them focus on the fun of travel.

For merchants and card issuers, the growing importance of contactless payments is a signal to accelerate its adoption to capitalise on the robust growth of travel into Japan. Learn more about how to get started, with data analysed by Visa Destination Insights.

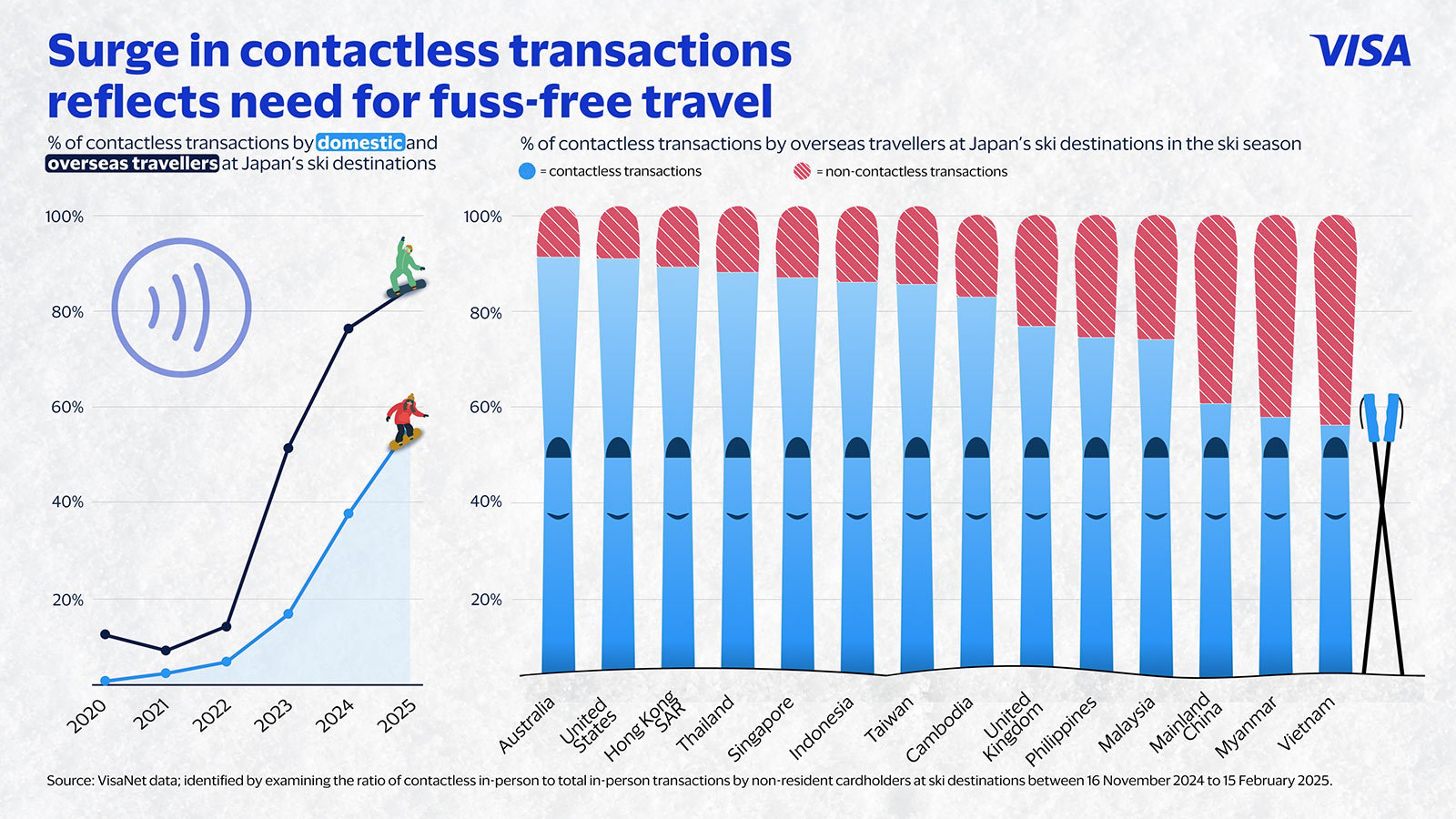

Surge in contactless transactions reflects need for fuss-free travel

Contactless payments are not just growing, they are how travellers want to pay today. According to Visa data, contactless transactions accounted for around 80 percent of all traveller transactions at Japan’s¹ during the ski seas²is approximately double from just two years ago, as travellers feel and appreciate the step up in experience that contactless payments bring to their travels.

Overseas travellers with contactless-enabled cards prefer to use them when they travel. Two-thirds of every dollar spent by travellers at ski destinations was made by contactless methods, versus around 50 percent a year ago. This shift is seen in the changing way travellers pay for “core” travel activities, with majority of lodging (~80%), dining (~90%), and retail shopping (~90%) spending being done with contactless payments, as travellers worry less about how to pay and prefer to pay with a tap of their cards or mobile phones.

It is no surprise to see³, but those from the rest of Asia such as Brunei, Cambodia, India, Mainland China, Malaysia, Myanmar, and Vietnam are also paying with contactless methods most of the time – a sign that contactless payments are fast becoming the norm for travellers everywhere.

What this means: The takeaway is clear – enabling contactless payments will be a springboard for travel spending growth. It is a recurring theme in Visa’s analysis of travel data, such as during the Sakura season in Japan and the Singapore Night Race last year.

For merchants, accepting contactless payments is no longer just a way to attract overseas travellers but is increasingly the gateway to customers at home and abroad. According to Visa data, approximately 55 percent of domestic travellers’ transactions at ski destinations are made with contactless methods, up from about 35 percent in the previous year⁴. If the habits of overseas travellers are any indication, contactless payments by Japanese travellers could be at an inflection point. As more domestic issuers speed up efforts to put contactless-enabled cards into the hands of consumers, this growth trend is set to accelerate further in the months and years ahead.

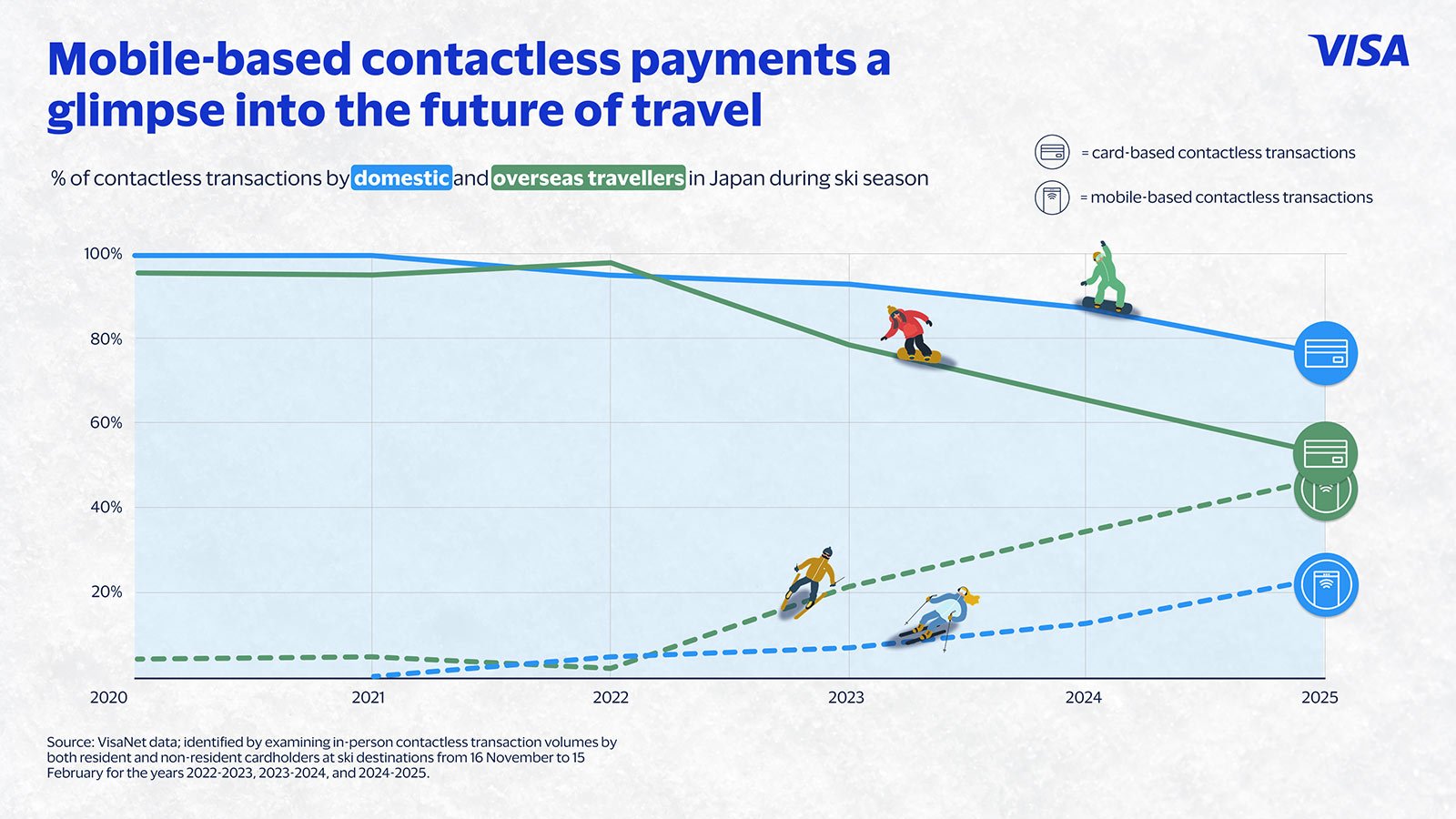

Mobile-based contactless payments a glimpse into the future of travel

As smartphones become more integral to consumers’ lives, they are becoming key to how they pay contactlessly on their travels. Indeed, cards are vanishing from travellers’ physical wallets and replaced by digital versions in their mobile wallets, readily accessible through smartphones. According to Visa data, nearly half of contactless transactions are mobile-based at ski destinations, growing from about 30 percent a year ago and approximately double that from two years ago⁵. While use among Japanese travellers is relatively lower at about 25%, it is still double that of just a year ago.

What it means: A mindset shift is underway - travellers want to worry less about how to pay on their travels and mobile-based contactless payments are a natural extension of this shift. Today, travellers do not need to worry about which cards to bring on their travels, knowing that their cards are widely accepted, easily accessible at a tap of their smartphones, and protected by security features such as Visa Token Service and others offered by trusted mobile wallets.

Merchants can stay ahead of the curve by not only fast-tracking contactless acceptance but also deepening their partnerships with trusted mobile wallets so that travellers find it easier to discover them and enjoy easy, convenient, and seamless payment experiences on their trips.

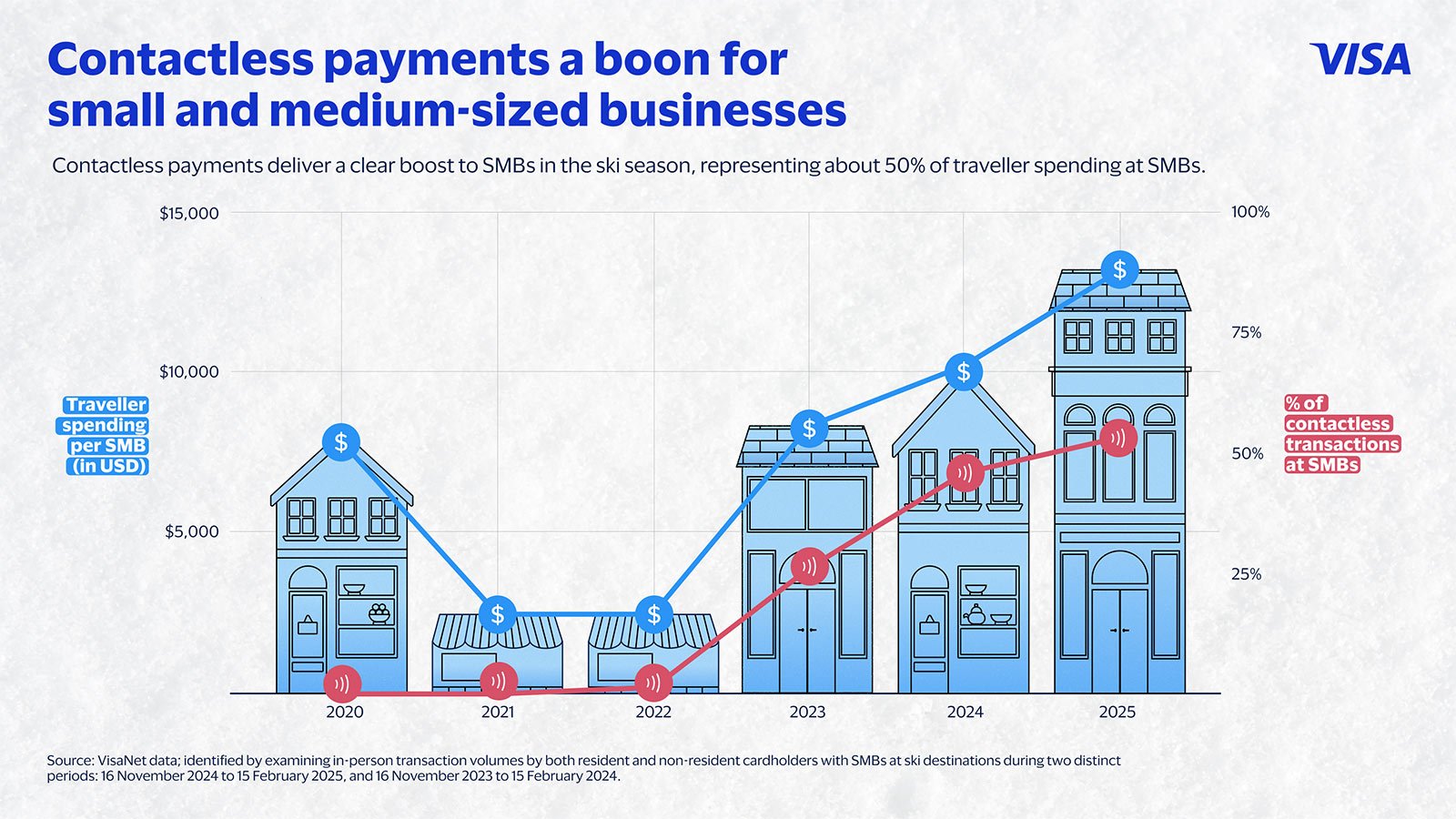

Contactless payments a boon for small and medium-sized businesses

For small and medium-sized businesses (SMBs) in Japan and Asia Pacific, digital payments have been a stumbling block because of questions around their costs, a perceived steep learning curve, and uncertainties about whether they boost revenues.

Yet according to Visa data, contactless payments brought a clear boost to SMBs during the ski season. SMBs at ski destinations⁶ on average saw an around⁷, over half of which was made through contactless payments. Contactless spending at SMBs mirrored the shift in core travel spending – lodging, retail, entertainment, and restaurants.

What this means: While SMBs may be justifiably apprehensive in adopting contactless payments, Visa’s data suggests that SMBs who act fast to accept contactless payments can reap significant benefits. Contactless payments are increasingly the future of travel in Japan and Asia Pacific and can be a springboard for all types of businesses, no matter how small.

Visa Consulting and Analytics (VCA) harnesses Visa’s payments expertise and proprietary analytics to deliver insights that drive better business outcomes and improve customer journeys. We help clients formulate strategies to capture the biggest payment opportunities, optimise portfolios, and execute on digital more effectively. Learn how you can work with VCA here.

_________________________________________________

¹ For simplicity in this analysis, ski destinations are defined by the specific city, town, village, or ward where popular ski resorts are located, using the most granular level available. The regions covered include: Niseko, Kutchan, Rankoshi, Yamanouchi, Yamagata, Furano, Nozawaonsen, Hakuba, and Yuzawa.

² Identified by both resident and non-resident cardholders who made in-person contactless transactions at ski destinations between 16 November 2024 to 15 February 2025. For resident cardholders, only those who had not made any transactions at the same ski destination in the previous six months were included.

³ Identified by examining the ratio of contactless in-person to total in-person transactions by non-resident cardholders at ski destinations between 16 November 2024 to 15 February 2025.

⁴ Identified by comparing in-person contactless transaction volumes by resident cardholders at ski destinations during two distinct periods: 16 November 2024 to 15 February 2025, and 16 November 2023 to 15 February 2024.

⁵ Identified by examining in-person contactless transaction volumes by both resident and non-resident cardholders at ski destinations from 16 November to 15 February for the years 2022-2023, 2023-2024, and 2024-2025.

⁶ Small and medium-sized businesses are defined as merchants with an annual merchant sales volume of less than 20 million yen.

⁷ Identified by examining in-person transaction volumes by both resident and non-resident cardholders with SMBs at ski destinations during two distinct periods: 16 November 2024 to 15 February 2025, and 16 November 2023 to 15 February 2024.