From the streets of Singapore to the shores of Shanghai, Asia Pacific is having a mobile revolution - fast, fearless, and transforming how millions pay every day.

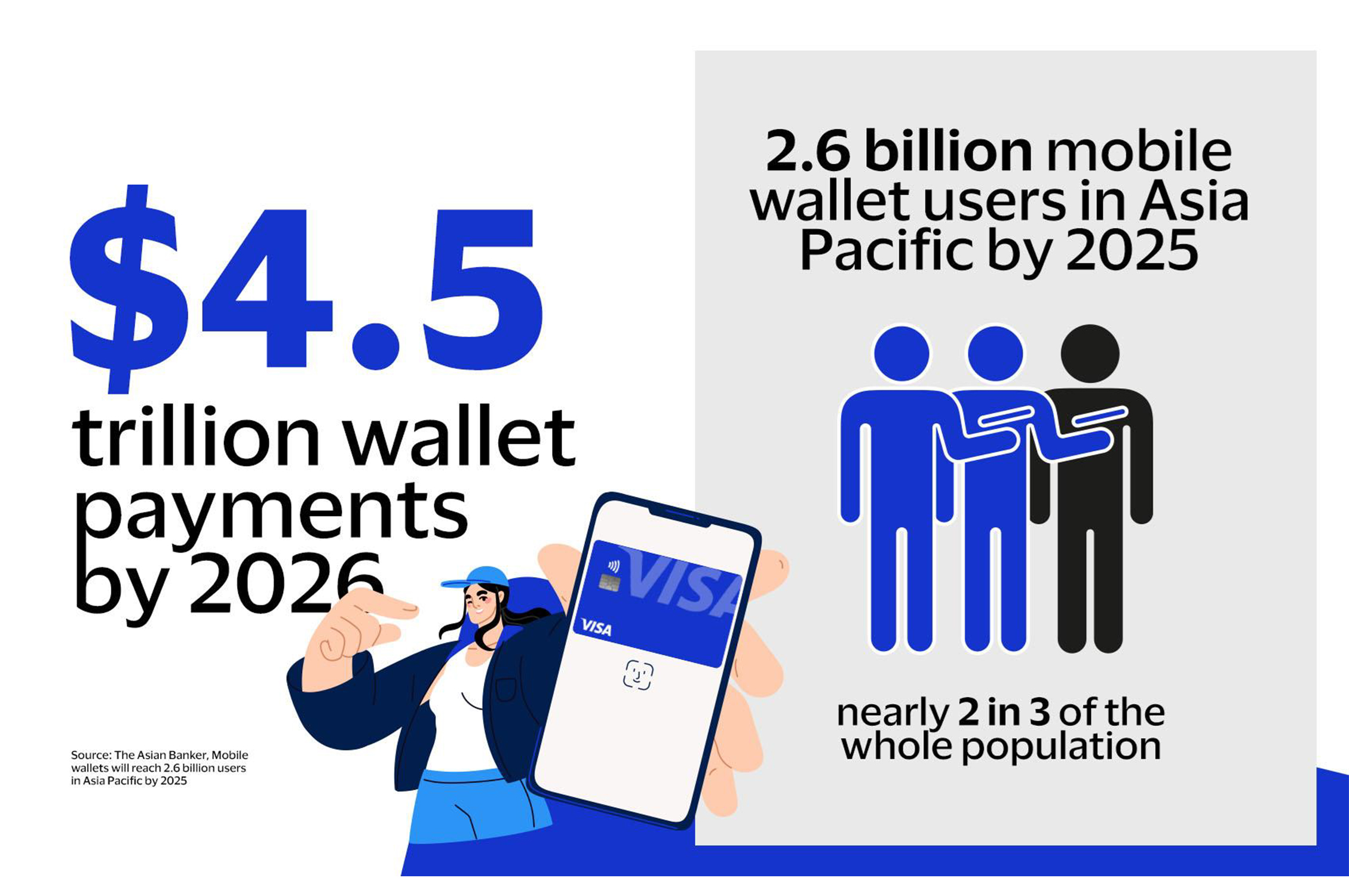

Visit any city in the region and you will see consumers paying with their smartphones, be it scanning QR codes at a food stall, making an account-to-account (A2A) transfer to their friends, or tapping their smartphone on a payment terminal. With mobile wallet users accounting for nearly two in three people in Asia Pacific this year, such “non-card payments” create new choices and conveniences alongside card payments that together are accepted (almost) everywhere.

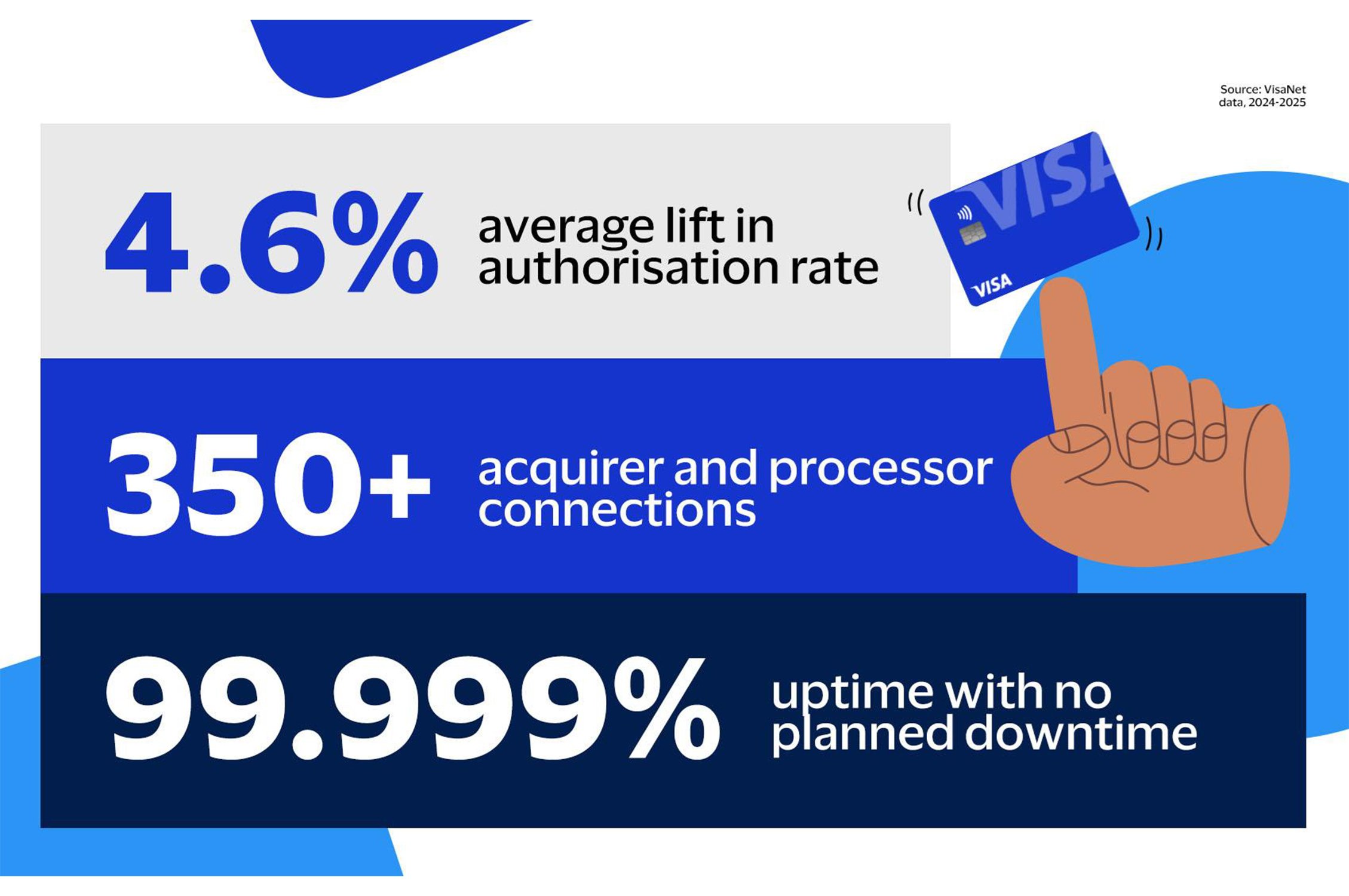

We say almost, because amidst this explosive growth, non-card payments are still largely limited to domestic use. Enter Visa Pay: it combines decades of Visa experience in digital payments and Visa’s global network to make non-card and wallet payments useful everywhere. With Visa Pay, consumers can use their mobile wallets wherever they go, and merchants enjoy unified digital acceptance with peace of mind.

The modern consumer is mobile-first

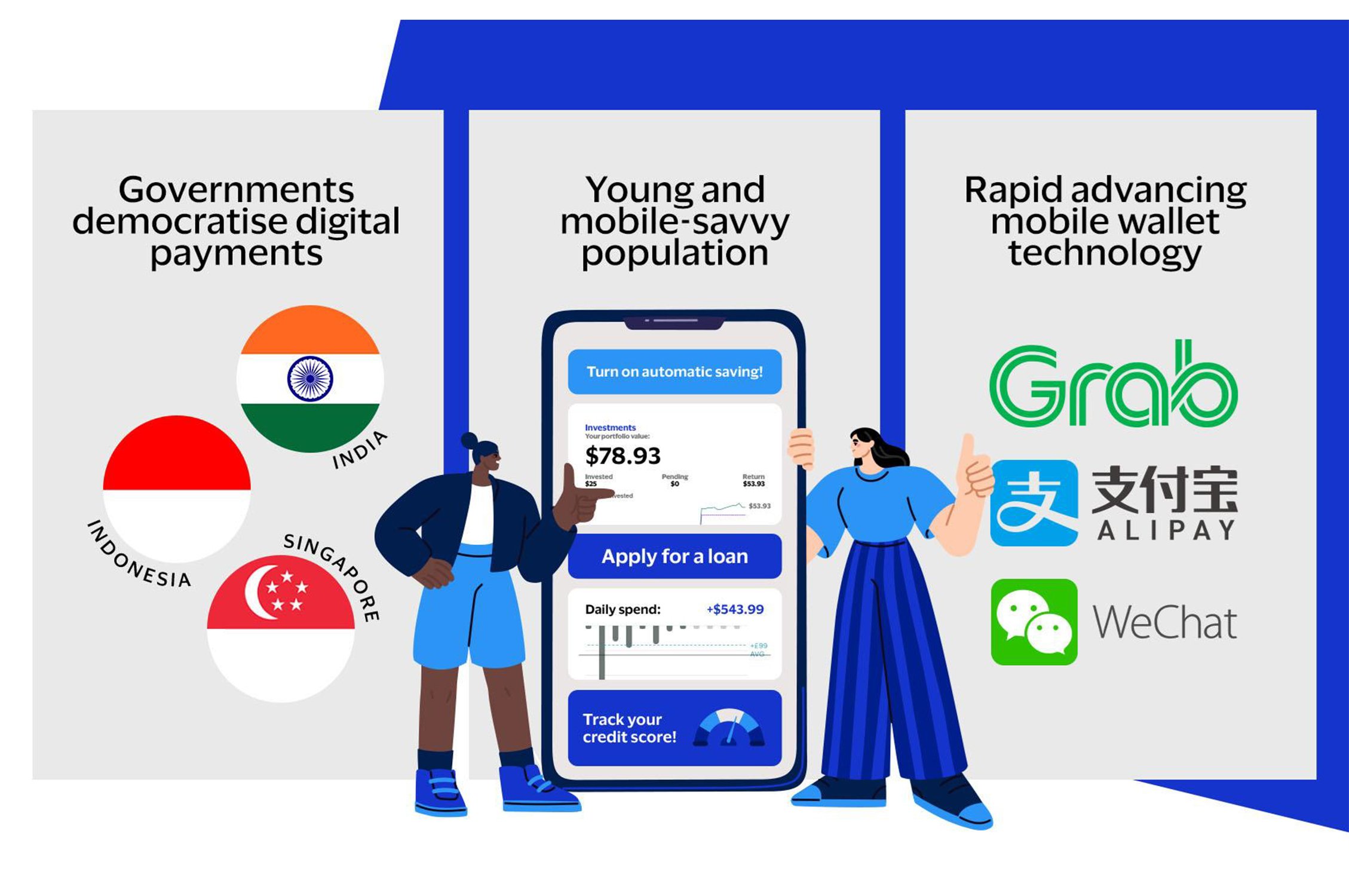

Asia Pacific has always been a hotbed for innovative payments, with a young and mobile-savvy population seeking faster and more convenient ways to pay, no matter where they go. Digital wallets are the latest step in this evolution, with apps like Alipay, WeChat Pay, Touch ‘n Go, and VNPay among others allowing users to pay with a scan or tap of their smartphones. Many digital wallets also let users provision their debit or credit cards, fuelling a contactless payments revolution led by Visa in the past decade.

In addition, domestic payment networks like PayNow in Singapore, QRIS in Indonesia, and the Unified Payments Interface (UPI) in India are also enabling real-time, account-to-account (A2A) transfers between local banking apps and digital wallets, making the smartphone ever more central to the way Asia Pacific pays and get paid.

However, in this mobile-first era of consumer payments, what is key is how networks can connect the dots between the different methods on offer and make them relevant no matter where consumers go.

Connecting the dots for non-card payments

Non-card payments are already reshaping payments in Asia Pacific. Today, consumers can scan QR codes with their smartphones to get groceries or open their mobile wallets to pay for shopping hauls. For merchants, it is easier than ever to accept a digital payment than before.

But there are hurdles non-card payments must overcome to reach their full potential. For one, non-card payments are still largely limited to domestic use. Bilateral linkages, such as the PayNow-PromptPay linkage between Singapore and Thailand are positive steps, but there is still some distance for local wallets to gain global acceptance.

Second is payment friction. The widespread availability of mobile wallets and real-time payment schemes creates convenience and choice for consumers, but they also create new cognitive burdens for consumers: the need to switch between different wallets across transactions and for merchants, the need to display multiple QR codes at the point of payment, and to juggle multiple accounting streams.

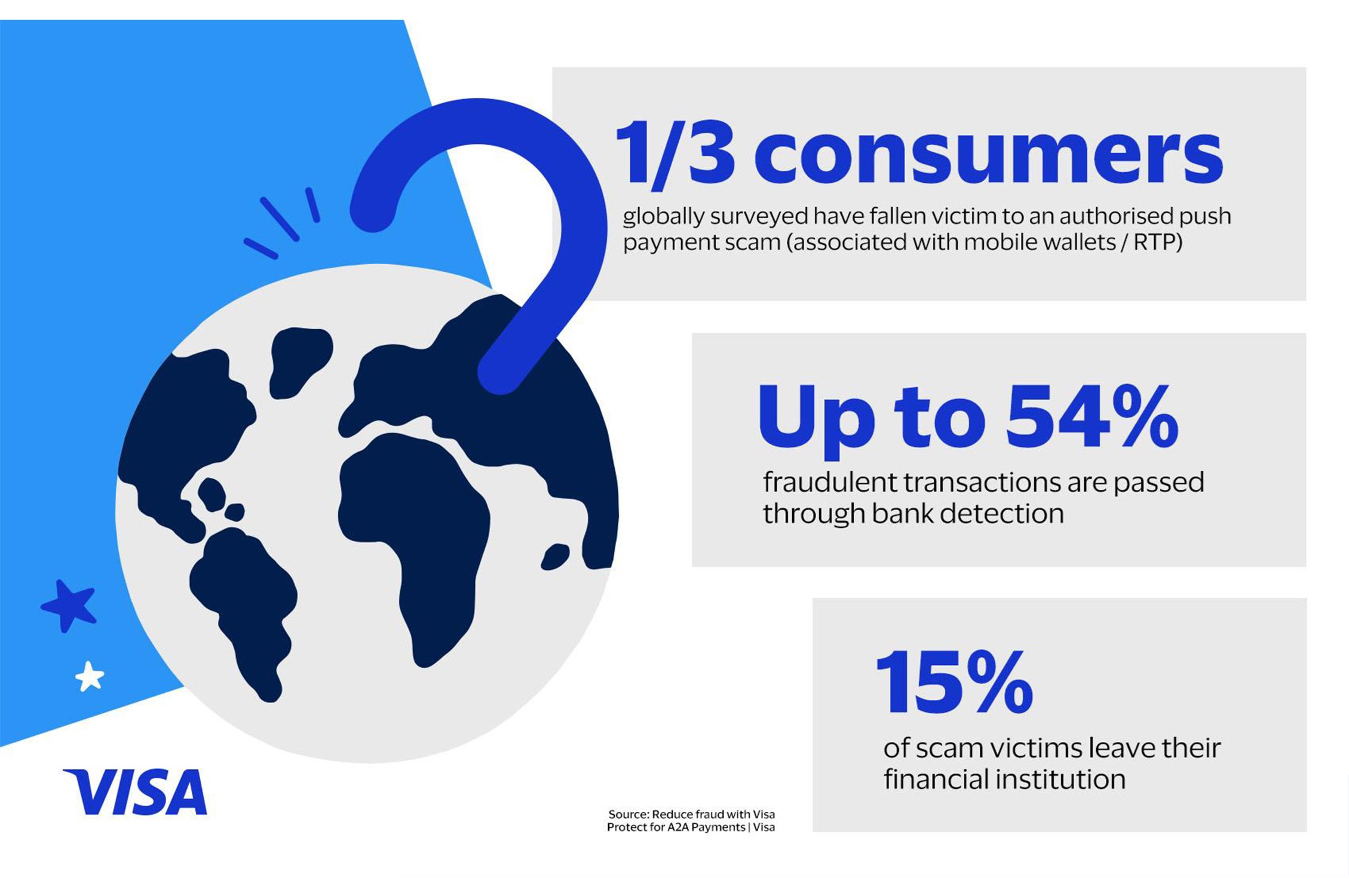

Third is a growing focus on security. The irrevocability of real-time payments is posing new challenges, making it tricky for banks and networks to recover consumers’ funds in the event of fraud, disputes, or incidental errors in money transfers. With non-card payment volumes rising rapidly, this can hinder trust in the ecosystem and damage growth aspirations.

The Visa Pay difference: global, frictionless, secure

Visa Pay for consumers: One wallet to unlock the world

Gone are the days of juggling different mobile apps - Visa Pay enables users to transact seamlessly at any Visa-accepting merchant globally with one wallet. This brings unprecedented convenience and security to consumers because Visa Pay transactions are tokenised, meaning that payment credentials are encrypted by Visa and never shared with merchants or other third parties.

Another bonus: Visa Pay transactions benefit from the same security and protections such as disputes and chargeback processes that card payments receive on the Visa network, creating greater peace of mind for consumers no matter where they go or pay.

Visa Pay for merchants: Unified acceptance, streamlined operations

Merchants in Asia Pacific increasingly seek one-stop digital acceptance, which reduces operational complexity, streamlines accounting, and welcome consumers from around the world.

Visa Pay can do exactly that – all merchants need to do is display their existing QR code that can accept almost all forms of consumer payments, drastically streamlining the way they operate and expanding their reach to more mobile wallet users worldwide This is supported by Visa Acceptance Solutions, which enables merchants to deliver a single, seamless checkout experience.

Visa Pay for banks: Improved security and integration

The growth of non-card payments is creating new challenges for banks, especially in terms of processing a larger volume of non-card transactions, navigating cross-border payment regulations, and strengthening fraud prevention.

Because Visa Pay transactions are not any different from any other Visa transaction processed on the Visa network, banks and financial institutions enjoy greater visibility over non-card transactions that are integrated with existing payment infrastructure. Most importantly, they benefit from stronger customer connections, as consumers tend to be significantly more engaged with their wallet applications than with their bank apps

Visa Pay for wallets: Effortlessly unlocking global reach

Visa Pay also enables mobile wallet providers to realise their global aspirations. Growing merchant networks is time- and resource-intensive, especially when it comes to adding overseas merchants outside of home cities.

Visa Pay can dramatically fast-track their acceptance footprints for providers, making their mobile wallets globally relevant almost instantly with a unified QR network and Visa’s payment network. In addition, Visa can help mobile wallets navigate regulatory barriers in cross-border payments, further streamlining their operations.

With reduced costs and complexity, mobile wallet providers can free up resources to unlock new opportunities with Visa’s value-added services such as loyalty programs, advanced payment analytics, and fraud prevention capabilities. In all, mobile wallet providers are better positioned to deliver seamless, secure, and innovative payments to their users.