With eCommerce now a way of life in Asia Pacific, consumers expect more in their online experience. For payments, convenience and speed are still key, but expectations have soared. Entering card details and one-time passwords used to be the norm, but today they bottleneck a mobile-first generation that wants frictionless checkouts every time.

Yet the need for speed does not mean security takes a back seat. In fact, it is a major deal clincher as consumers will abandon purchases if they feel transactions are insecure.

So why are frictionless and secure payments so crucial to the future of eCommerce in Asia Pacific? Read our insights from the Visa Green Shoots Radar report to find out.

Friction is fatal as consumers seek faster payments ...

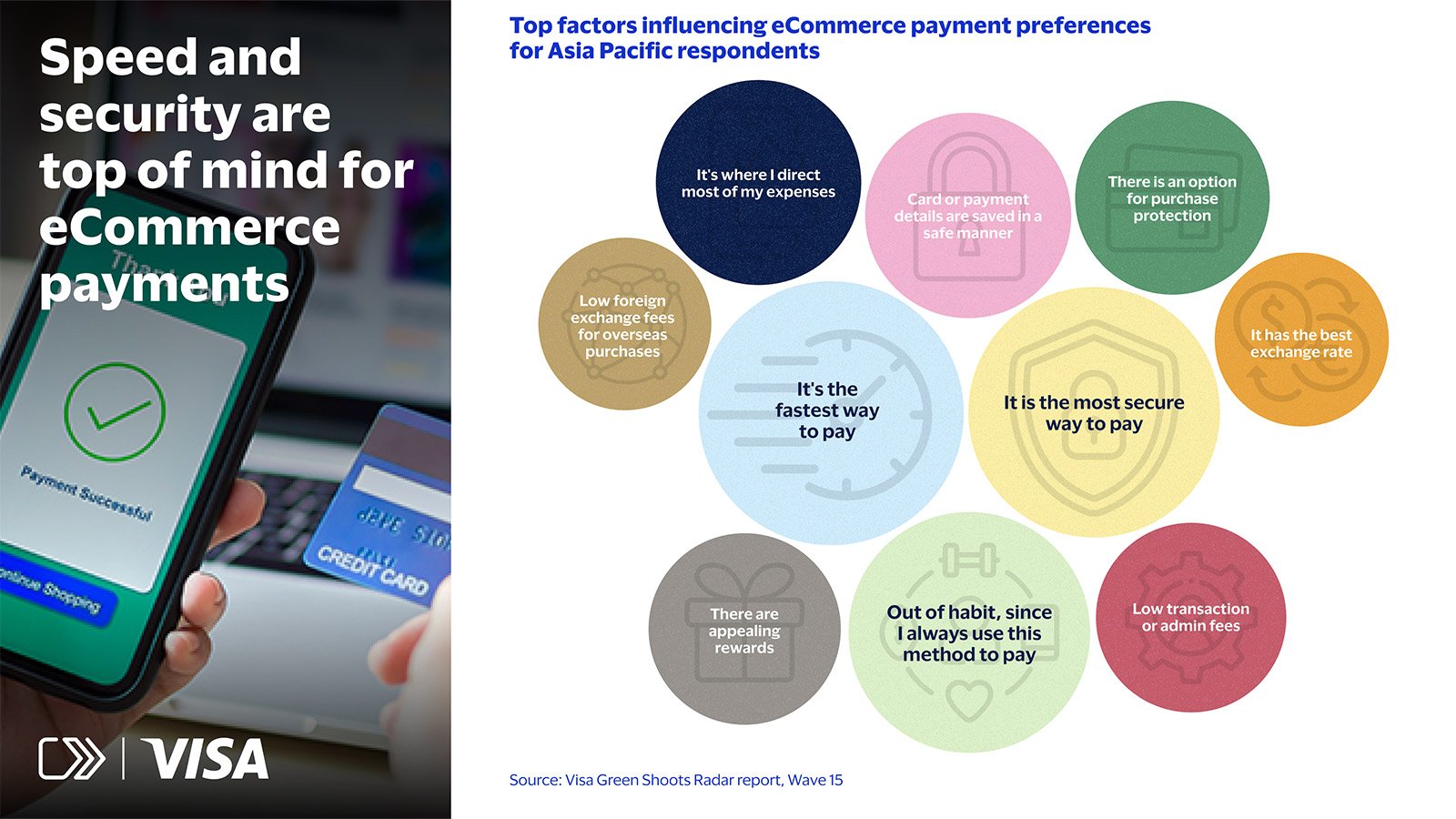

Online shoppers today increasingly demand fast and secure payments. In fact, according to the Green Shoots Radar report, speed (38%) and security (35%) are the top two factors influencing payment preferences among respondents in Asia Pacific.

In Asia Pacific, cards are the tried-and-trusted way to pay for online purchases, especially for cross-border eCommerce. According to the Green Shoots Radar report, they are the most used payment method by consumers, when they shop from overseas online merchants. 46 per cent of respondents use credit or debit cards to pay for cross-border eCommerce purchases, versus 22 per cent for digital wallets.

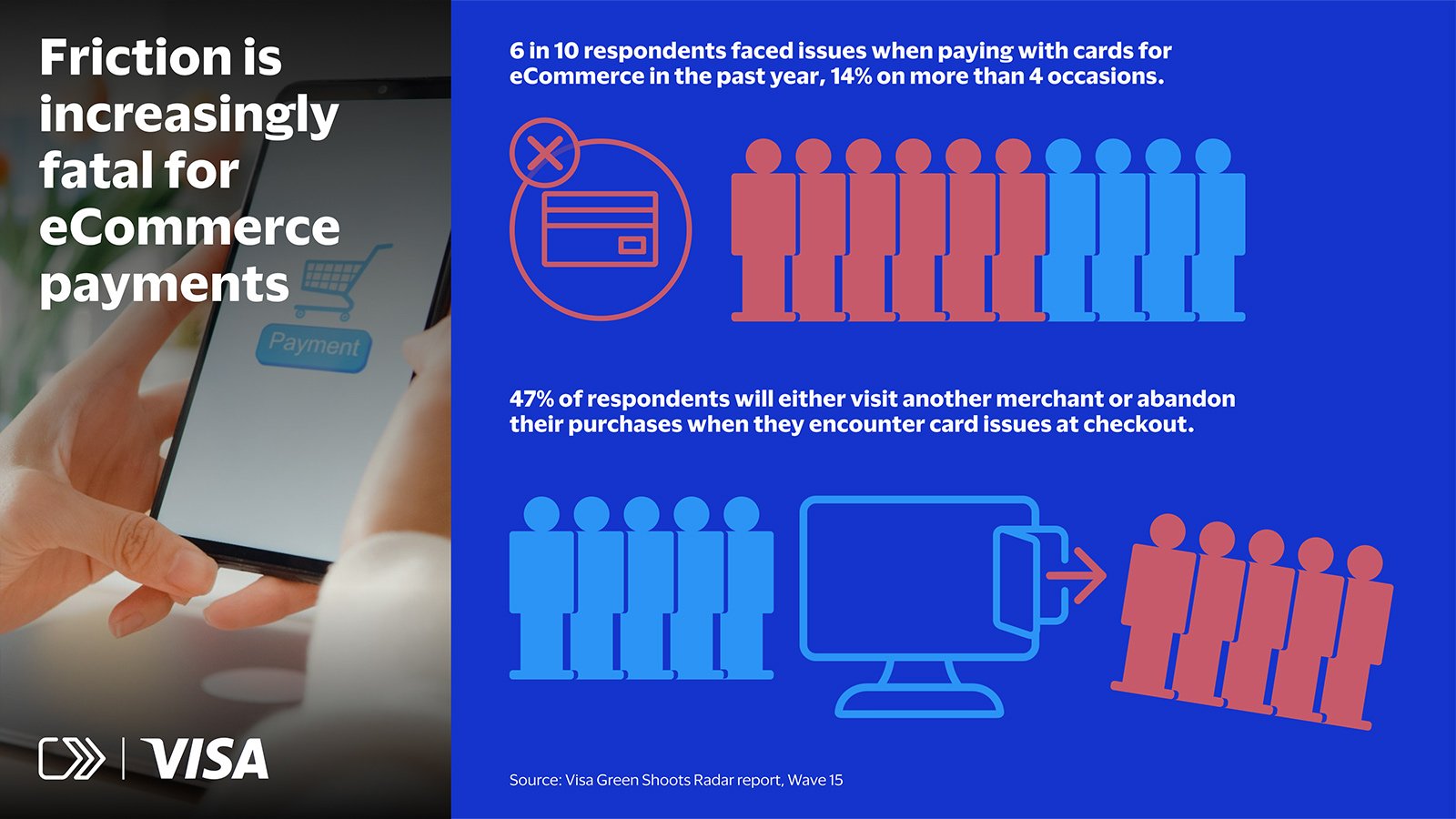

But new expectations of speed are fast impacting issuers and eCommerce merchants today. According to the Green Shoots Radar report, 6 in 10 respondents have experienced issues with their cards at least once in the last year, and 14% on more than four occasions. These range from a failure to receive One-Time Passwords (OTPs) at checkout, forgetting their 16-digit card numbers when making a mobile order, and more.

These points of friction often translate into lost sales for merchants and missed revenues for issuers, as 47 per cent of respondents said they will either visit another merchant or abandon their purchases if they encounter issues with their cards at checkout.

... but the lack of security remains a deal breaker

As eCommerce merchants and card issuers think about reducing payment friction, it must not come at the expense of payment security. Consumers in Asia Pacific use cards online because they offer familiarity and assurance: 16-digit card numbers, One-Time Passwords (OTP) from banks, banking alerts, and network security features such as Visa’s EMV 3D Secure and Visa Token Service (VTS).

In fact, among the top factors for choosing to pay for eCommerce purchases, card-based security such as the saving of card details in a safe manner (23%) and purchase protection offered by card payments (21%) were regularly raised alongside security.

Click to Pay: Hitting the sweet spot

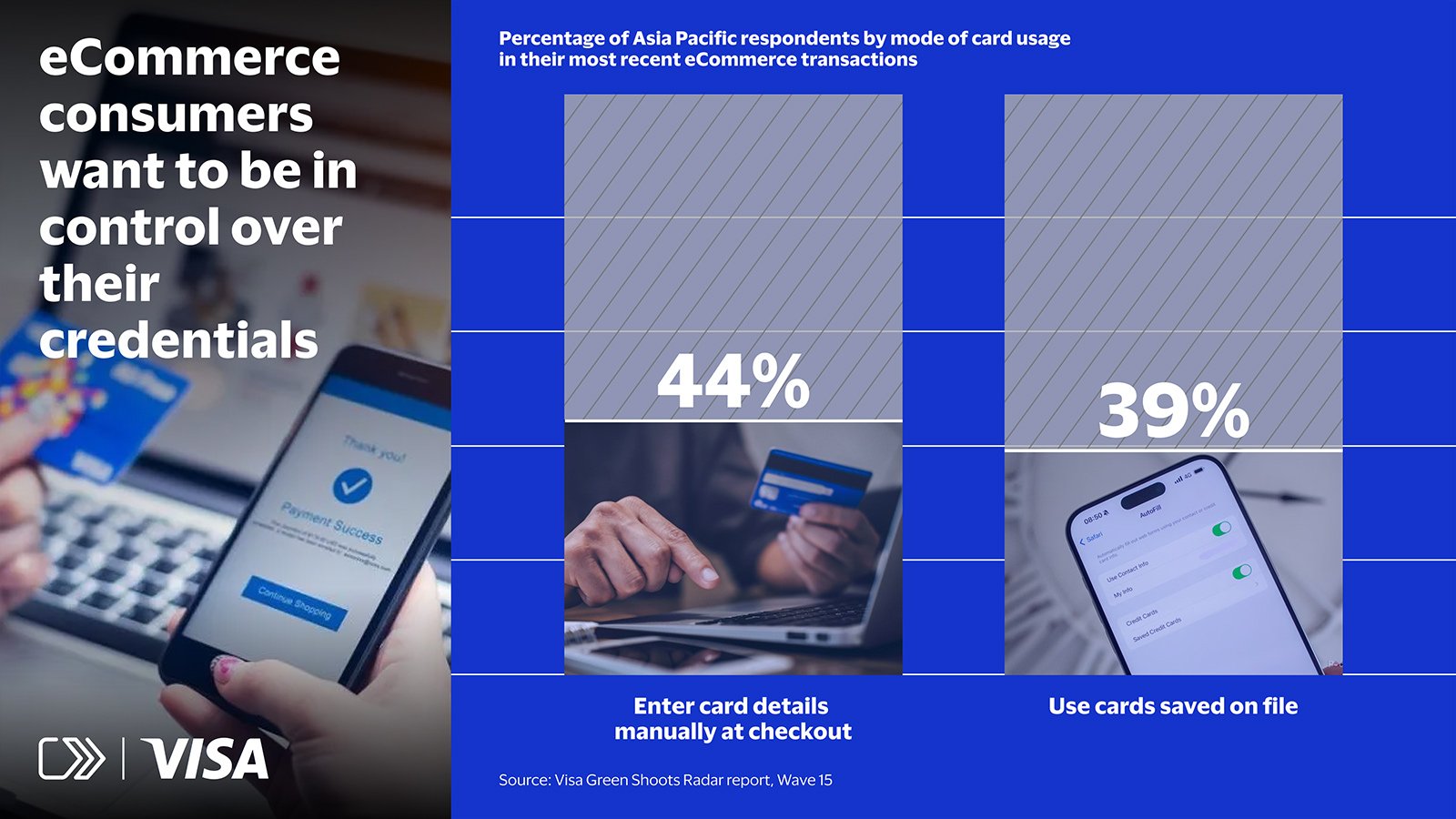

How can issuers and eCommerce merchants balance the need for speed and security by today’s consumers? Solutions must be able to reduce payment friction, give consumers control over who they share their card details with, and importantly, offer the same level of security they have come to expect from card payments.

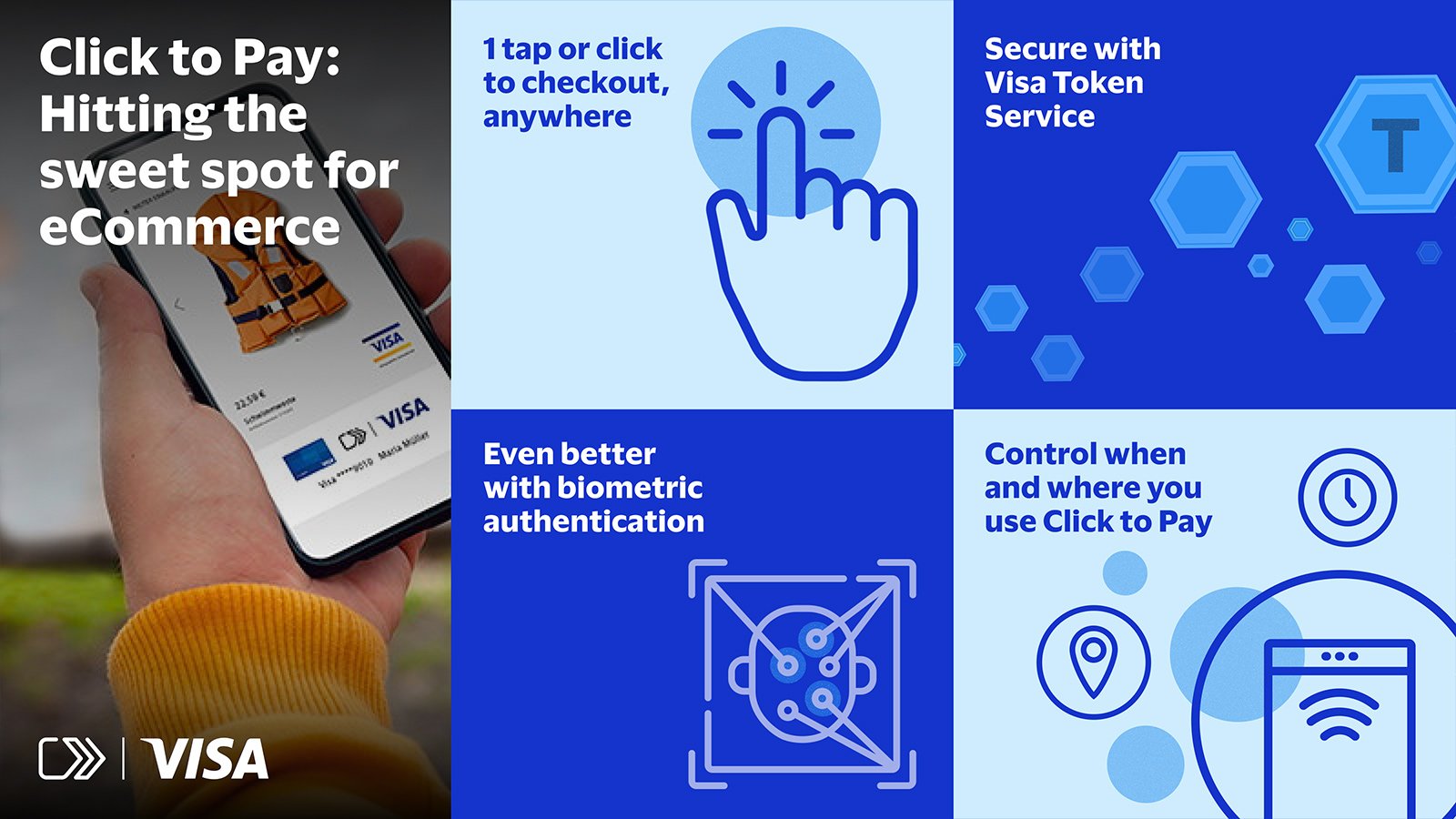

With Visa Click to Pay, they can find the sweet spot. It dramatically reduces checkout time from minutes to seconds. When consumers enroll a card to Click to Pay, they can rest assured that card details are saved only on Visa and protected by the Visa network.

At checkout, this means no more filling forms, forgotten entering incorrect card numbers, and missed OTPs. Consumers can choose to use Click to Pay at merchants worldwide to check out at with a few taps of their finger, safe in the knowledge that their payment credentials are not shared outside the Visa network.

Consumers can also set up Visa Payment Passkey that uses their native mobile device’s biometric capabilities, such as facial recognition, to authenticate Click to Pay transactions on the go. Built on Visa Token Service that replaces sensitive card information with secure tokens, it has shown to reduce fraud by 58%¹ and increase authorisation rates by 2.5% in Asia Pacific², meaning faster and safer payments for consumers, and increased revenues for merchants and card issuers.

Consumers in Hong Kong will be among the first to experience this new gold standard in secure and frictionless eCommerce checkouts, as part of Visa’s partnership with ZA Bank. As more card issuers and merchants bring Click to Pay to life, eCommerce in Asia Pacific will be safer, faster, and more seamless than before.

This article is the second of Commerce of Tomorrow, a series that highlights the changing face of commerce and the payment innovations that will transform how we buy and sell in the years to come.

Read our first article here.

_________________________________________________

¹ Visa Risk Datamart, Global FY22 Q1-A4 Token Fraud Rate vs PAN Fraud Rate by PV for merchants with over 1,000 CNP token transactions per month per country. Merchant’s individual results may vary.

2 VisaNet, Oct-Dec 2022, Visa credit and debit card-not-present transactions for tokenized vs non-tokenized credentials in the AP region. Authorisation rate is defined as approved authorisations divided by total authorization attempts based upon a first attempt of a unique transaction.