Online shopping has long been a reality in Asia Pacific, starting with web-based storefronts over two decades ago, before eCommerce platforms and tools emerged to make buying and selling over the Web easier than ever.

Today, it has grown to become a way of life. Consumers are shopping online more often and for more of their needs – from everyday necessities to personal care to luxury goods. Visa’s latest Green Shoots Radar report also showed that online shopping is increasingly global, mobile, and platformed, especially among younger consumers.

These will require the ecosystem to rethink eCommerce payments, especially in card-not-present scenarios, to deliver easy, seamless, and secure experiences to consumers, no matter where consumers shop from.

Everyday shopping is going online, but so are hobbies and luxury

The growing use of eCommerce is driving a wider variety of online purchases, as people turn to a wide variety of online merchants, be it on websites or on eCommerce platforms to meet their needs.

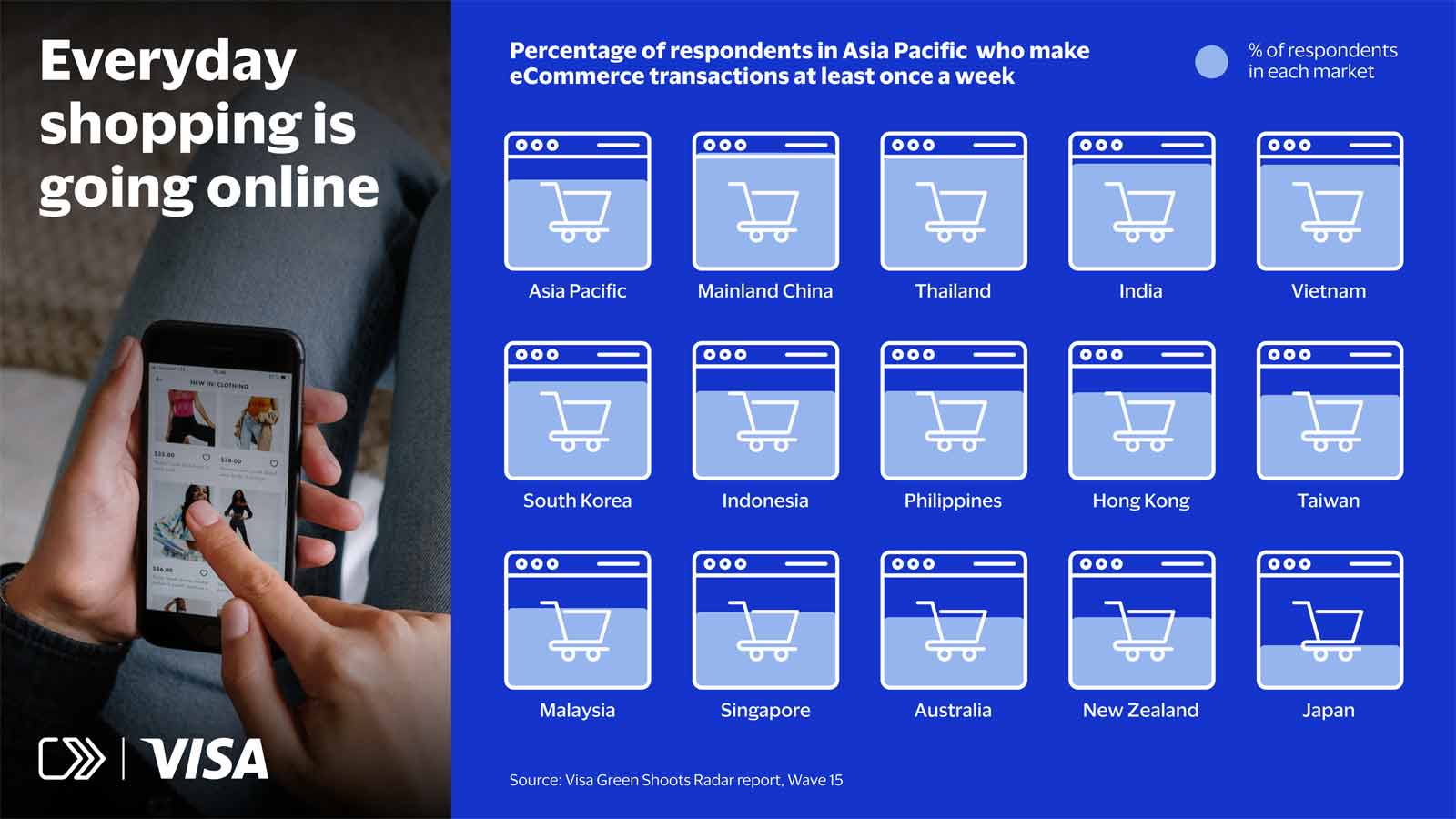

According to Visa's Green Shoots Radar report, a significant 66% of respondents in Asia Pacific said they make eCommerce transactions at least once a week, with the figure as high as 86% in Mainland China.

In the same report, 48% of respondents indicated that they have shopped for fashion, such as clothing and accessories, online. Groceries follow closely at 47%, while personal care comes in at 45%. This indicates a growing role that eCommerce plays in helping consumers save time on routine purchases.

Meanwhile, consumers also shop overseas for their personal interests and hobbies, as eCommerce makes it easier for them to discover products they love internationally. 23 per cent of respondents said they shop from overseas online merchants for luxury products, followed by 22 per cent for arts and crafts and gaming respectively.

Gaming is seeing robust growth, as more than half (53%) of respondents have bought gaming-related products and services online in the past year, especially Millennials (54%) and Gen X (57%) consumers.

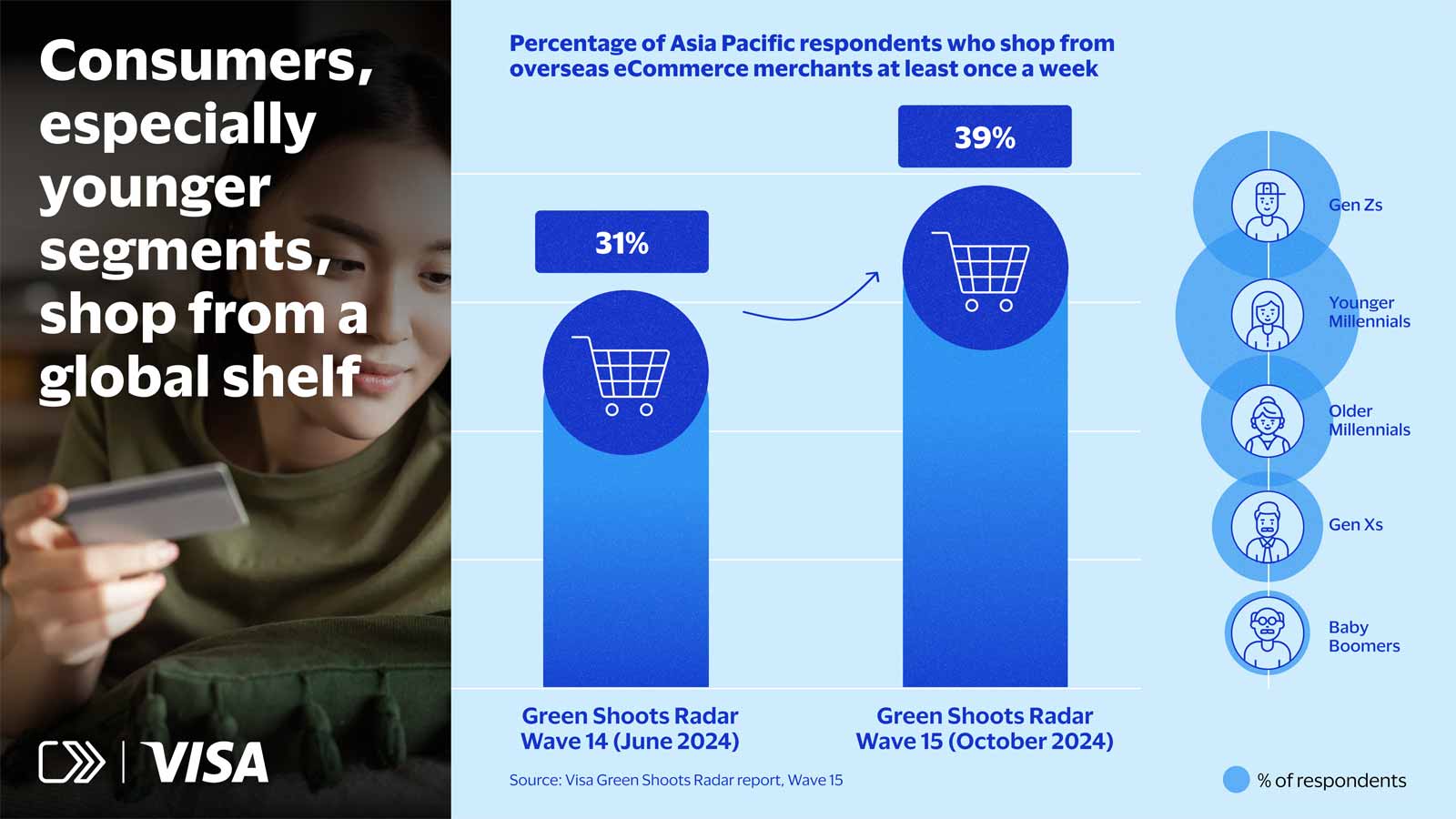

Consumers, especially younger segments, shop from a global shelf

Consumers are also shopping off global shelves. Cross-border eCommerce purchases have accelerated across recent editions of the Green Shoots Radar report, with the latest showing that 39% of respondents shop from overseas eCommerce merchants at least once a week, compared to 32% in the previous edition in June 2024. Respondents in Indonesia, Mainland China, Thailand, and Vietnam shop online from overseas merchants most often.

More significantly, Gen Zs (aged 18 to 26) and Younger Millennials (aged 27 to 34) are leading this surge with 47% of Gen Z respondents and 49% of Younger Millennial respondents stating they shop globally at least once a month.

Evolving card-not-present payments for a mobile-first generation

An implication of eCommerce adoption is the rise of card-not-present payments (CNP), referring to card-based transactions where consumers do not physically present their cards to merchants at the point of payment.

As eCommerce becomes mobile and an “always-on” routine in Asia Pacific, the rising frequency, velocity, and variety of online purchases across websites and platforms create new challenges and opportunities for the payment ecosystem.

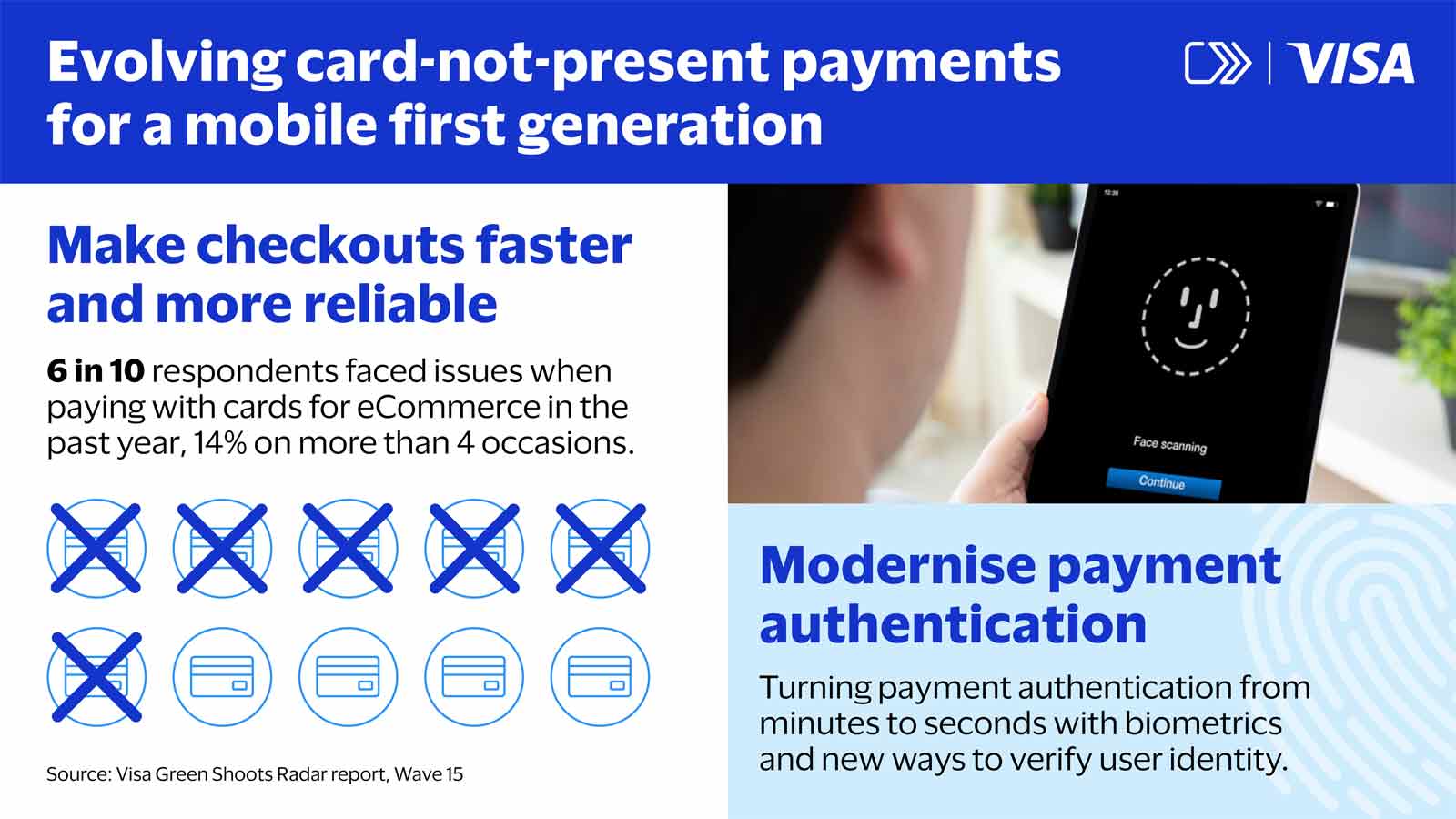

The first is faster and more reliable checkout solutions that work consistently, no matter where consumers shop online. According to the Green Shoots Radar report, 6 in 10 respondents faced issues when paying with cards for eCommerce purchases at least once in the last year, and 14% on more than four occasions. These range from forgotten card details to not receiving One-Time Passwords (OTPs) or banking app alerts to authenticate a transaction, leading to abandoned shopping carts or using other payment methods.

Addressing this requires a rethink of card credentials. Visa Token Service, which replaces 16-digit card numbers with secure encrypted tokens, is already making digital transactions safer for consumers, but the next step is to create unified card-not-present experiences that foster trust in every transaction, whether consumers shop on their mobile devices or computers, apps or websites, and locally or overseas.

The second is modern authentication for a mobile-first generation. Traditional payment authentication methods - such as manual entry of 16-digit card numbers and card security codes, bank alerts, and OTPs – are still effective today, but can be cumbersome for consumers shopping on the go on their phones.

With more mobile phones today offering biometric capabilities, such as fingerprint and facial recognition, biometric forms of authentication, such as the Visa Payment Passkey, can complement payment tokenisation technology to make eCommerce payments more frictionless and secure.

As you will see, frictionless and secure payments will be critical to the continued growth of eCommerce in Asia Pacific. Stay tuned to find out why they are so important, and how Visa is transforming eCommerce payments for the region.

This article is the first of Commerce of Tomorrow, a series that highlights the changing face of commerce and the payment innovations that will transform how we buy and sell in the years to come.