Visa Accelerator Program

The Visa Accelerator Program was created to help startups unlock their growth potential and scale across the Asia Pacific region, by collaborating on joint solutions that address the biggest opportunities in digital payments.

Together with Visa’s payment experts, product architects and business development teams, startups in the Visa Accelerator Program get to rapidly co-develop, test, and iterate new solutions, while pursuing tangible go-to-market opportunities with our extensive network of financial institutions, merchants and digital partners over a course of six months.

Now in its fourth year, the Visa Accelerator Program has enabled the growth of some of Asia Pacific’s most prominent startups.

Applications for our 2024 program are now closed.

Why apply?

Rapid Testing

- Test and validate your solution efficiently through a focused Proof of Concept (POC) to generate maximum impact within a short timeline

- Get equity-free funding of up to US$50,000, at Visa's discretion, to support your POC

- Get business and technical support to build and deploy your solution

Access & Partnerships

- Get exclusive introductions to Visa’s global network of clients and partners

- Explore tailored partnerships and commercialisation opportunities post-program

- Follow-on integration with Visa ecosystem initiatives and programs

Exclusive Mentorship

- Access Visa leadership and subject matter experts to build your roadmap

- Dedicated Visa Sponsor and POC working team, to open doors and champion your startup

- Access Plug & Play’s renowned mentor network to fast track your growth

Scale Your Business

- Expand into new regions with our market-specific expertise

- A fast track for follow-on pilots, commercial agreements, co-creation, and even potential funding for successful POCs across Asia-Pacific

- Get recognised on the global stage as one of the elite startups accepted into the program

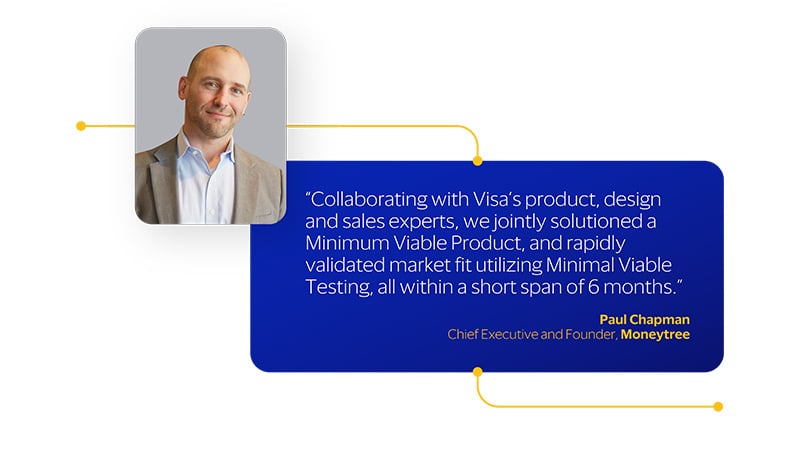

Hear from our previous cohorts

Build the future of commerce with Visa

![]()

Artificial Intelligence (AI)/ Generative AI

How might we harness artificial intelligence, particularly generative AI, to power transformative payment experiences?

-

- Generative AI Solutions

- Customer Experience Enhancement

- Fraud Monitoring & Prevention

- Risk Management

- Dispute Management

![]()

Embedded Finance

How might we reshape the fusion of financial services into existing journeys to create seamless offerings across all payment methods?

-

- Fintech-as-a-Service

- Social Commerce

- Multi-rail / Alternative Rail Payments

- B2B Platform Enablers

- Lending

![]()

Global Money Movement

How might we transform the future of cross-border money movement in an increasingly global consumer and business environment?

-

- FX & Cross-currency Liquidity & Management

- Supply Chain Payments

- Tuition Payments

- Earned Wage Access

- Creator Payouts

![]()

Digital Acceptance for MSMBs

How might we empower Micro, Small & Medium Businesses to easily and rapidly start accepting and making card and non-card payments at scale?

-

- Creator Economy & Social Sellers

- Faster Seller Onboarding

- Real-time Payments

- Low-to-No Touchpoint Payment Experiences

- E-Invoicing

![]()

Loyalty of the Future

How might we redefine loyalty for businesses to acquire and encourage deeper interaction, with the consumers of tomorrow?

-

- Segment Focused Loyalty (Affluent, Gen Z)

- Targeting & Segmentation for Businesses

- Hyper-personalization

- Pre & Post Transaction Customer Engagement

- Omni-channel Merchant Loyalty

Who are we looking for?

Mission Alignment

Startups with solutions addressing one of the following opportunity areas:

- Artificial Intelligence (AI)/ Generative AI

- Embedded Finance

- Global Money Movement

- Digital Acceptance for MSMBs

- Loyalty of the Future

Proven Solution

Startups with a market-tested solution that has gained traction

A clearly articulated scope and business rationale for a POC with Visa

Growth Stage

At least 9-12 months runway (Series A and above)

Resources available for POC testing with Visa (startup can dedicate time and focus without impacting core operations)

Asia Pacific Focus

Startups that demonstrate commitment to expanding in Asia Pacific

Existing operations in the region is a plus

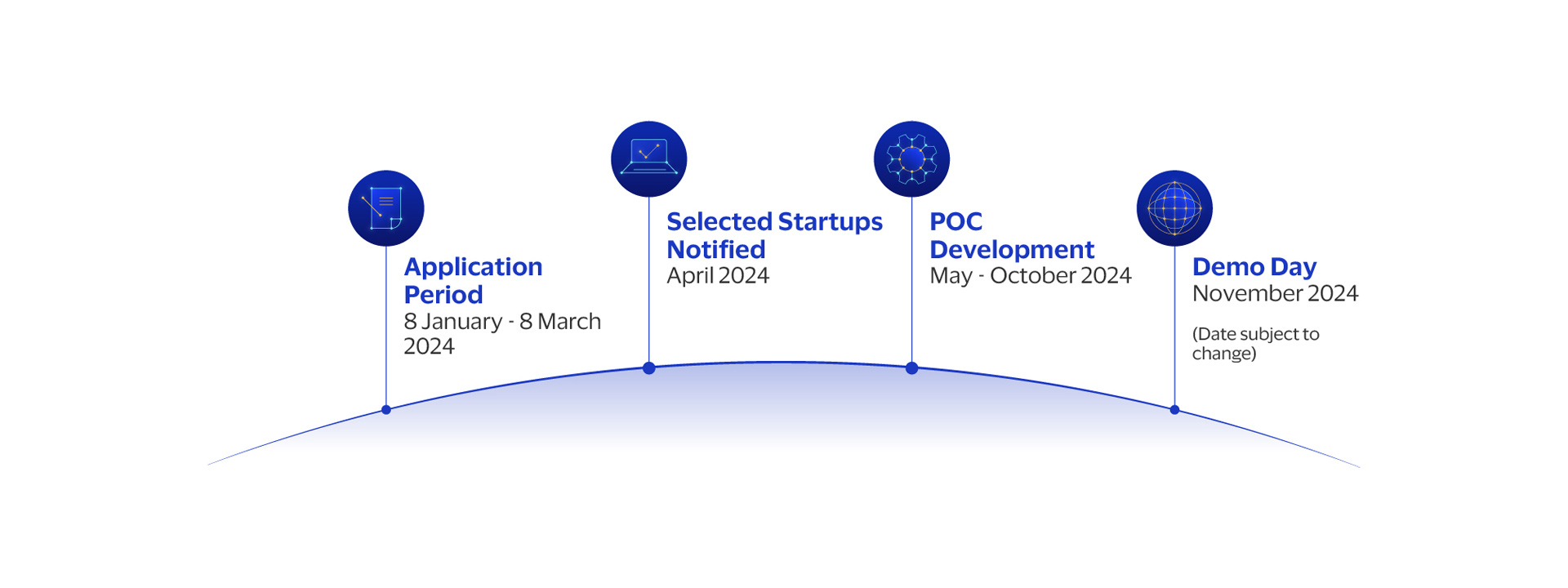

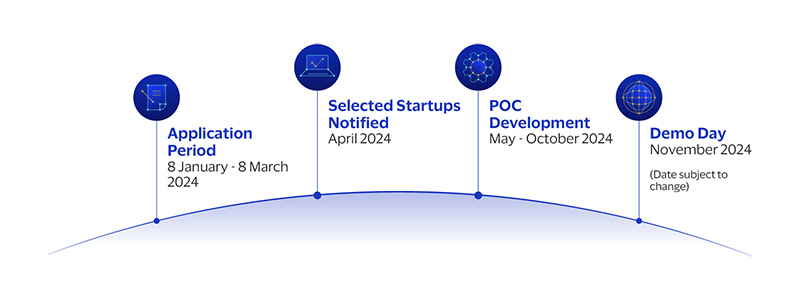

Program Timeline

Meet Our Startups

Global Money Movement

Open Banking & Embedded Finance

Merchant Acquiring & SME Enablement

Digital Currencies & Blockchain

Playbux

Playbux provides a fully integrated Web 3.0 community platform with commerce activities, blockchain technology, NFTs, and virtual communities.

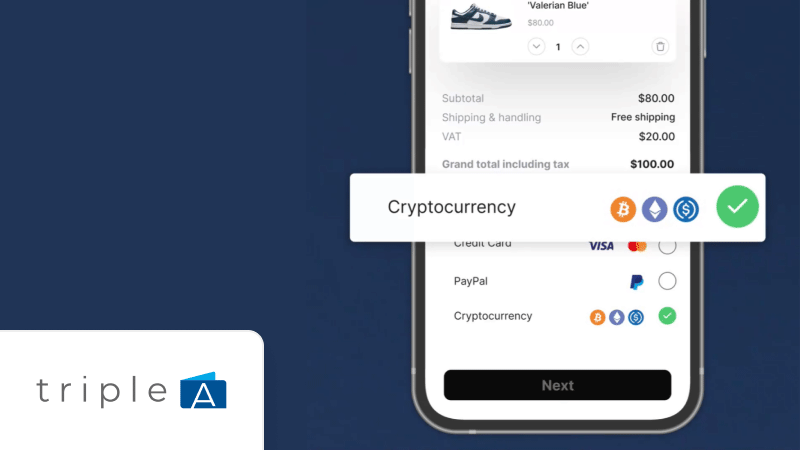

TripleA

TripleA, licensed by MAS, enables crypto payments and payouts for businesses.

Events

Demo Day 2023 @ SFF

Startups presenting their solutions at the Singapore Fintech Festival during the Visa Accelerator Program Demo Day.

Visa Booth @ SFF

Startups demo their solution their co-created solutions at Visa’s booth at the Singapore Fintech Festival.

For FAQs, please click here. |

For Terms and Conditions, please click here. |

| Contact us at [email protected] | For Global Privacy Notice, please click here. |

For Plug and Play Privacy Notice, please click here. |