The Formula 1TM Singapore Grand Prix kicked off a surge in tourism and travel spending in the city during the week of the race – with nighttime spending and affluent travel playing a particularly important role.

But the race has a larger-than-life impact on the city and the region beyond the initial spark in tourism. Deeper analysis by Visa beyond the race found that while Singapore is the main destination for racegoers and motor racing fans, the race itself also serves as a launchpad for further travel into Asia Pacific and beyond – with affluent travellers again at the fore.

Singapore Grand Prix: a gateway to Asia Pacific

According to Visa data, about 20%¹ of travellers who visited Singapore had additional travel plans after the Formula 1TM weekend. While travellers on average spent about 4.5 days² in Singapore during the week of the race, its location at the heart of Asia meant it was a gateway to the rest of the region as travellers who made extended travel plans³ spent an average of 3.5 more days⁴ on the move after the races concluded in Singapore.

Diving deeper into the data, post-race travel is especially prominent for long-haul visitors from outside of Asia, as Visa data shows that about 35%⁵ of them travelled to at least one other country after the race week, higher than the average. Their top destinations included neighouring countries Indonesia, Malaysia, and Thailand which were as short as a 40-minute flight from Singapore, while Australia and Japan were also popular for those keen to explore more of Asia Pacific.

This suggests that for travellers, especially those from other continents, Singapore is a valuable pitstop for an extended trip across Asia Pacific, extending the travel boost to Asia’s diverse offerings from urban havens like Jakarta, Kuala Lumpur, Bangkok, Tokyo, and Sydney to laid back beachfronts like Langkawi and Phuket.

More importantly, post-race travel spending continued to be robust as travellers spent about 40%⁶ more per person on their extended trips than they would back home. The heaviest spenders⁷ were travellers from the United States, Australia, and Mainland China, but among the top were also travellers from Germany and France, reflecting how the Singapore Grand Prix mobilises the global fanbase of Formula 1TM to travel across Asia and beyond.

During their extended travels, travellers were eager to experience the best of local culture and offerings. In countries like Malaysia, Indonesia, and Thailand, restaurants and eateries were top of travellers’ spending, reflecting their reputations as food havens while traveller spending on retail were more prominent in Japan especially on department stores, as well as in Australia as travellers spent more heavily on groceries, apparel and accessories, as well as at department stores. In Japan, travellers spent the most on lodging, perhaps to sample its breadth of onsens (hot springs) and charming resorts.

What it means: Singapore’s prime location in the region and easy access to the rest of Asia, combined with its reputation for hosting major sporting and cultural events, means that neighbouring cities stand to benefit from the tourism that flows into the city even after the events are concluded.

What matters is how and where the biggest opportunities lie for merchants and businesses – Visa’s data shows that the shape of travel and spending varies for different destinations and armed with the right insights from Visa, merchants and issuers can identify key post-event travel patterns, uncover traveller profiles such as countries of origin, and understand their spending patterns to put themselves in pole position to capture the travel flows that emerge. This will also be valuable data for travel authorities, who can invest in their local offerings and spotlight key destinations that travellers can visit as they extend their travel footprint beyond the major events.

Affluent travellers dominate post-race tourism and spending

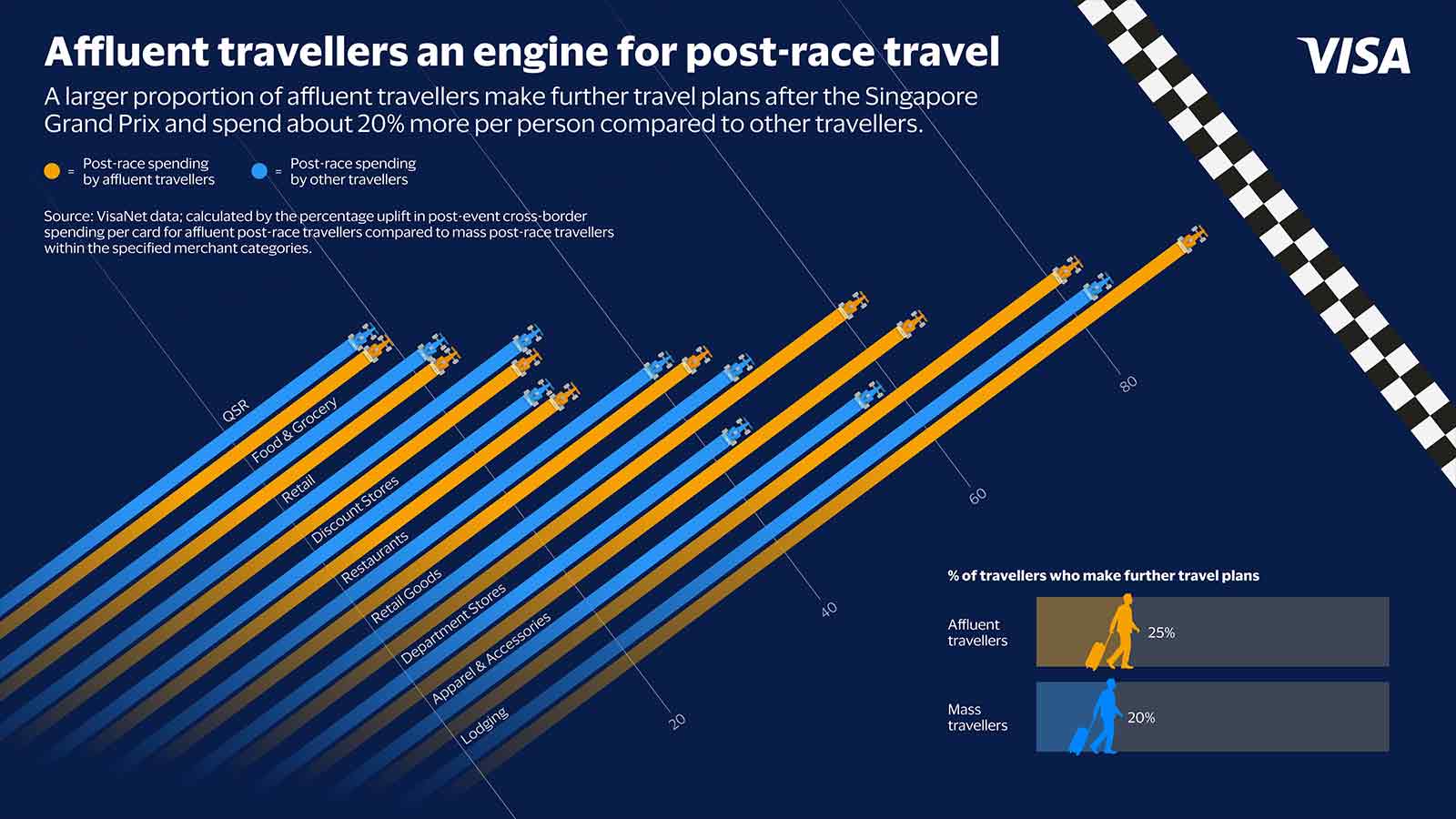

Post-race travel is more pronounced among affluent⁸ travellers. According to Visa data, more affluent cardholders make further travel plans after the Formula 1TM weekend, with about 25%⁹ doing so compared to 20% across all cardholders.

On average, this segment of travellers also spent about 20%¹⁰ more per person than other travellers after the Singapore race weekend. While Malaysia, Indonesia, and Thailand were similarly the most popular destinations, many affluent travellers also ventured further to the United Kingdom, United States, and to Europe like France, Italy, Germany, and Spain.

Another important difference is what affluent travellers are spending on. Compared to the rest of travellers, they spent about 65%¹¹ more in department stores and around 50% more on apparel and accessories than other travellers on their post-race journeys, revealing robust demand for retail therapy after a weekend of race-watching.

Singapore or not, travellers are paying more contactless-ly than ever

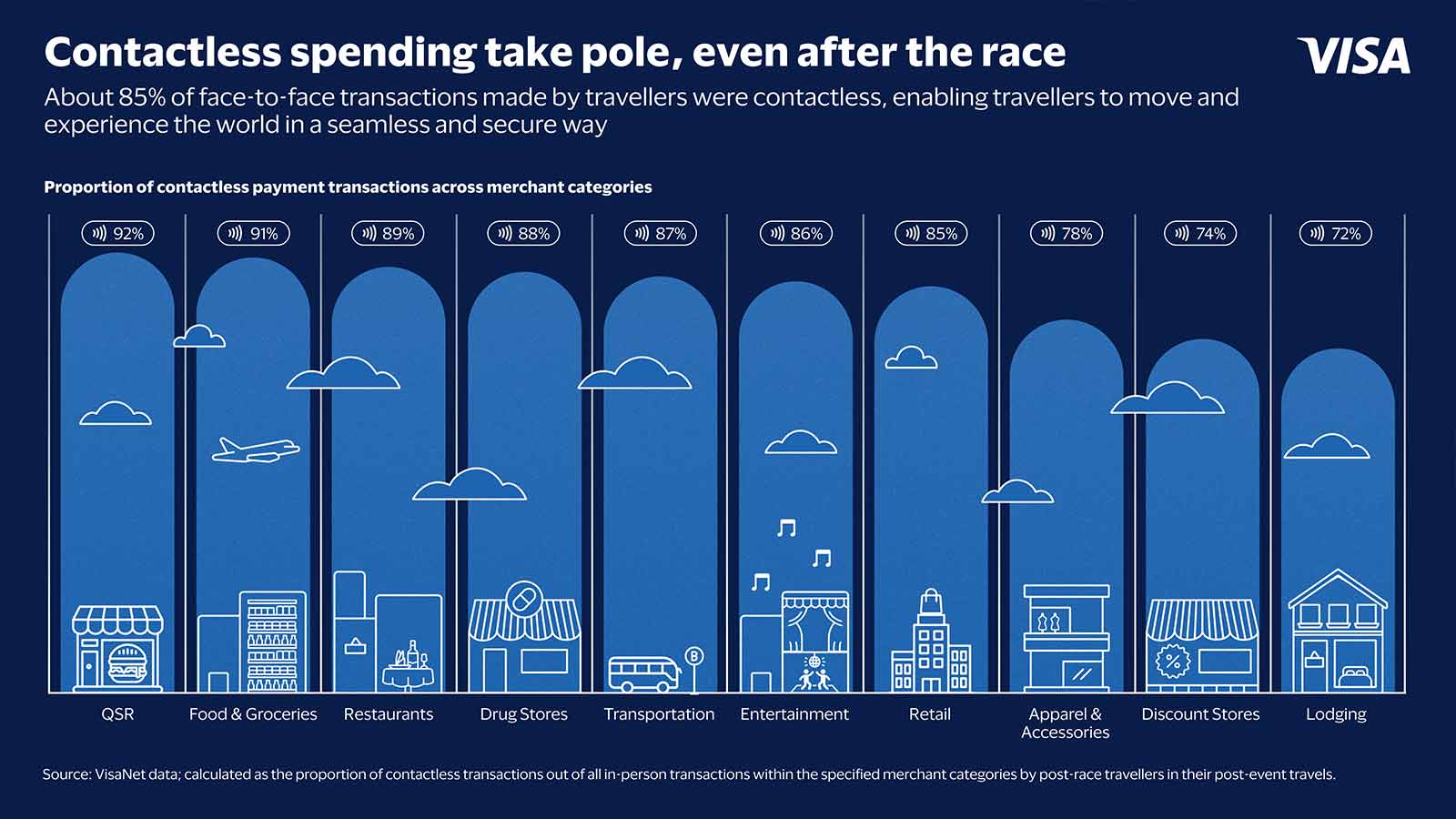

While contactless payments were a feature of traveller spending in Singapore during the week of the race, these habits persisted on their post-race travels. Visa found that about 85%¹² of all face-to-face transactions made by travellers were done via contactless card payments.

Compared to the race week, the volume of contactless transactions per day made by travellers grew by about 20%¹³, signalling that the seamlessness and security of contactless payments are creating lasting habits that make them part and parcel to the way people travel not just in Asia Pacific, but around the world.

While travellers from markets with mature contactless ecosystems like Australia and the United Kingdom had near-universal usage at about 95%¹⁴, the use of contactless payments by travellers from regions where the technology is still developing, especially Japan, Malaysia, Thailand, Vietnam, Indonesia, Cambodia, reached or exceeded 80%.

Further analysis on the type of contactless spending also shows the wide-ranging adoption of the technology in various aspects of travel and commerce – with the percentage of contactless payments exceeding 85%¹⁵ in usual areas like restaurants, groceries, and entertainment but also in areas like transportation. This reflects the value of contactless payments in simplifying how travellers consume, and how they enable travellers to move and experience the world in a more secure and seamless way.

Visa Consulting and Analytics (VCA) harnesses Visa’s payments expertise and proprietary analytics to deliver insights that drive better business outcomes and improve customer journeys. Our team of consultants, data scientists, and experts harness the global reach of the Visa network and cutting-edge technology including Agentic AI to help clients formulate strategies that capture the biggest payment opportunities, optimise portfolios, and execute digitally more effectively.

Learn how you can work with VCA here.

Disclaimer: “Formula 1TM” is a trademark of the Formula One Licensing BV, a Formula 1 company. Visa has no commercial affiliation or sponsorship relationship with Formula One Licensing BV. All insights and data provided are based on VisaNet data covering two weeks after the Singapore Grand Prix.

___________________________________________

¹ Identified as the proportion of international visitors who made at least one in-person transaction in Singapore during the event week and then made at least one in-person transaction in another country afterward.

² Calculated by taking the average duration between the 1st transaction and the last transaction of international visitors who made at least 1 card-present transaction in Singapore during race week. Cut off period is one week pre-race to one week post-race.

³ Post-race travellers identified by international visitors who made at least one in-person transaction in Singapore during the event week and then made at least one in-person transaction in another country afterward.

⁴ Calculated by taking the average duration between the 1st cross-border transaction and the last cross-border transaction of post-race travellers that is not in Singapore. Post-race travellers whose first and last transaction is on the same day is filtered out.

⁵ Based on the proportion of visitors who travelled to another country post-event, broken down by flight haul.

⁶ Calculated by comparing the post-event cross-border spending per card of attendees to their domestic spending per card during a benchmark period. China and India is excluded from calculation due to domestic data limitations.

⁷ Calculated by proportion% of total cross border spend that is not Singapore in the post-race week

⁸ Affluent cardholders are identified by Visa Signature and Visa Infinite product tiers (Visa Gold and Visa Platinum in Japan). All other cardholders are classified as mass

⁹ Calculated as the proportion of affluent or mass visitors who travelled to another country post-event.

¹⁰ Calculated by the percentage uplift in post-event cross-border spending per card for affluent post-race travellers compared to mass post-race travellers

¹¹ Calculated by the percentage uplift in post-event cross-border spending per card for affluent post-race travellers compared to mass post-race travellers within the specified merchant categories

¹² Calculated as the proportion of contactless transactions out of all in-person transactions made by post-race travellers in their onward-travel destinations that is not Singapore

¹³ Calculated by comparing the average daily number of contactless transactions made by visitors during their post-event travel to their average daily contactless transactions in Singapore.

¹⁴ Calculated as the proportion of contactless transactions out of all in-person transactions made by post-race travellers in the specified onward-travel country

¹⁵ Calculated as the proportion of contactless transactions out of all in-person transactions within the specified merchant categories by post-race travellers in their post-event travels