Tomorrow’s travel, today

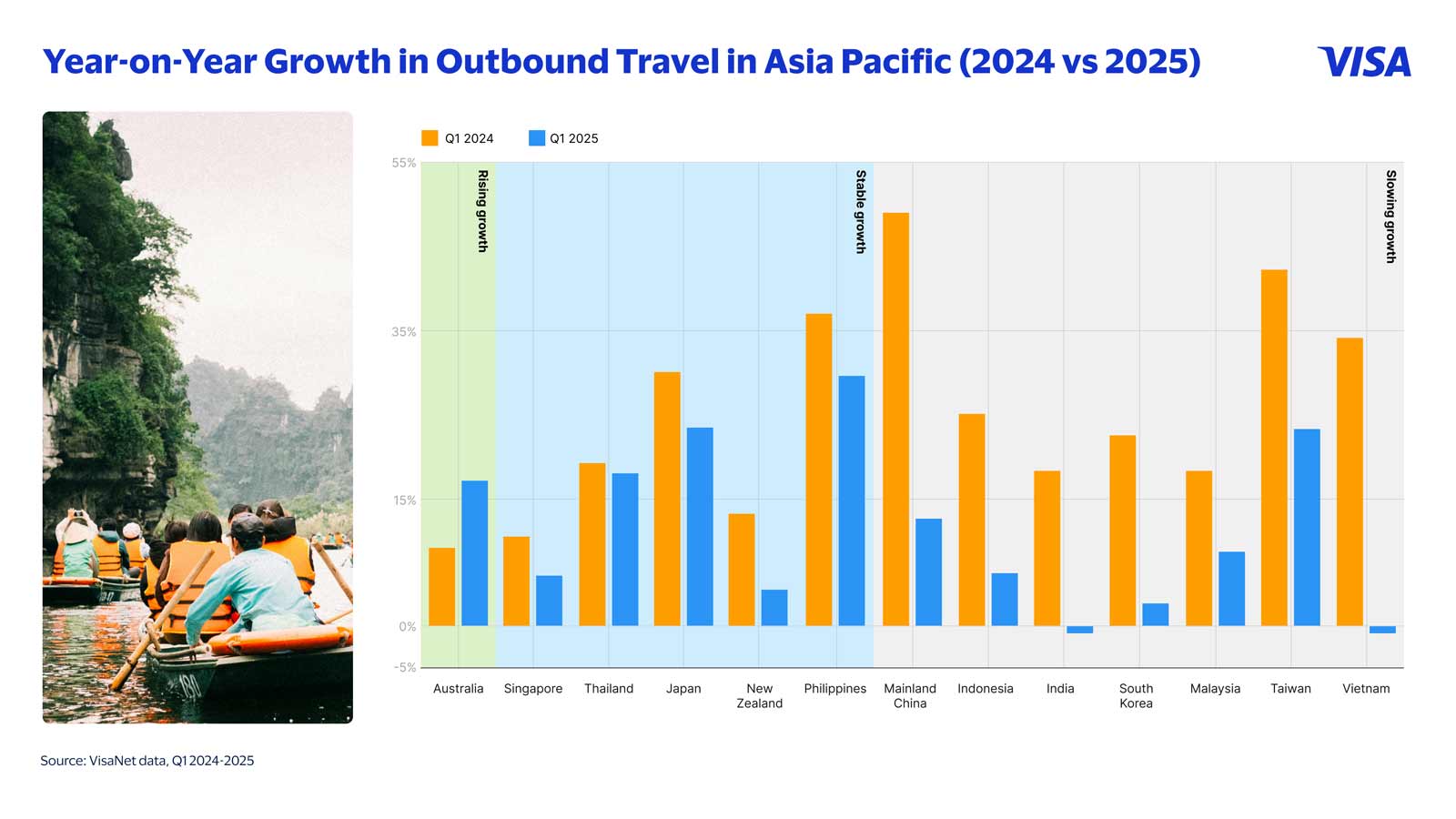

More people in Asia Pacific are travelling. To make the most of this, tourism businesses need effective marketing strategies that drive conversions, increase ancillary revenue, and deepen customer engagement. Lasting relationships with customers are important to maintain value through volatile periods in the industry. Visa’s International Travel model estimates that outbound travellers from the region grew by 32% from 2023 to 2024. This growth has continued, albeit at a slower pace, in the first quarter of 2025, with traveller numbers up 25% year-on-year. This does, though, mask some quite divergent trends across individual corridors.

Digging into global data is important to help identify and validate new route opportunities and underlying travel behaviour, which cannot always be ascertained from flight itineraries. By analysing the places where people spend in person, additional insights into real origin and destination travel demand can be uncovered. Aggregated VisaNet data also uncovers Australia as a key travel market where outbound traveller growth continues to accelerate, despite a recent period of particularly high inflation that consumers have endured, followed by steady growth from Singapore, Thailand, New Zealand, Japan and the Philippines. Conversely, in many of the large emerging markets of the region, such as India, Indonesia, Vietnam and Malaysia, the growth rate of outbound travel is falling, in line with stalling income growth for the middle classes¹.

Chinese travel dreams

India’s middle class under pressure

Vietnam a rising star

Travel to Southeast Asia accounts for a little over one-third of total inbound travel within Asia Pacific, and its share has been trending upwards in recent years. Asia Pacific’s fourth-biggest individual corridor is Singapore to Malaysia, where Singaporeans take advantage of cheaper shopping, restaurants and rentals, amidst an increasing degree of cross-border economic cooperation traversing the Johor Singapore Special Economic Zone.

Other major components of Southeast Asian arrivals are those from Mainland China, Indonesians going to Malaysia, South Koreans going to Vietnam, and Malaysians going to Thailand. As a destination, Vietnam is clearly the rising star: seven of the top 10 fastest-growing bilateral corridors in Southeast Asia in Q1-2025 were bound for Vietnam, as its relatively low costs are attractive for travellers, especially when combined with a famous coastline, warm weather and popular food.

Sakura sunrises

Rapid growth in travel to Japan is a big global travel story. Already a popular destination before the pandemic, its appeal has been boosted by a historically weak currency. Traveller numbers grew by an estimated 48% in 2024 as people flocked to enjoy its quality goods, elevated cuisine and rich cultural history.

In the first quarter of 2025, however, traveller growth decelerated to 24% in year-on-year terms: still fast growth, but perhaps the first sign that the incredible boom in arrivals may be nearing its peak and that travellers’ hunger for new destinations will never be sated.

New destinations for technology

Technology is ubiquitous, and travel is no exception. Business travel follows investment in tech corridors such as that between South Korea and Vietnam, while leisure travellers are going to a wider range of destinations and needing dedicated travel payment products, such as multicurrency wallets, and demanding low or no foreign exchange fees. Protection from fraud is particularly important for cross-border payments. According to Visa’s travel surveys, demand for these products currently runs ahead of supply.

Three in four consumers in Asia Pacific report having interacted with AI agents in customer service, travel planning, and shopping. Industry players within the travel ecosystem are swiftly implementing AI-driven travel and trip assistants to help consumers plan itineraries and deliver hyper-personalised offers, aiming to capture a larger share of travel spending. While AI is currently primarily used for trip planning, its evolving capabilities to enable secure checkout experiences will make it an essential component of the travel booking process. It is imperative that ecosystem participants develop readiness for this advancing technology.

Opening my wallet

Visa’s surveys of consumers across Asia Pacific have repeatedly told us in recent years that, across many markets, travel is the big-ticket item that people want to protect, even when households are under financial pressure. Higher consumer price inflation and currency depreciation have eroded spending power. The post-COVID recovery has also been slow in some markets, like Thailand and Hong Kong. Faced with headwinds, consumers have to make choices about what to prioritise when budgeting for a trip. Combining spending data with mobility data can enhance airport and other retail strategies, while knowing which destinations people are visiting and where they’re visiting from, as well as what they buy, assists in optimising store mix, boosting sales, and improving customer experiences.

Looking at Visa’s data on cross-border travellers’ in-person spending (excluding online purchases), we see that they spent almost 50% more at discount stores in 2024 than they did in 2023: the fastest growth of any major travel category. When it came to filling their stomachs, spending at quick service restaurants and on groceries both grew at a faster rate than restaurant spending, suggesting that people are keeping overall food costs in check by preparing some meals in their accommodation or eating at cheaper restaurants on a day-to-day basis. While they still splurge on restaurants, it happens less frequently and is likely also linked to a social media post about the experience. The most drastic savings, however, have been made on accommodation, where spending has grown at less than half the rate of the average travel category. The increasing numbers of single travellers, in line with ageing populations, fewer marriages and falling birth rates in Asia Pacific, are likely playing a role in a gradual deprioritisation of accommodation.

What to buy in 2025 and how to sell it

Based on year-to-date data from VisaNet, it looks like 2025 will be another good year for traveller spending at discount stores and quick service restaurants, while electronics and healthcare are gaining share of wallet at the expense of entertainment, retail goods and apparel. As older consumers make up a larger share of travellers in the region, we expect that healthcare will continue to gain prominence as a motivation to visit. Many emerging economies in the region have under-invested in public healthcare systems, leading people to seek better quality treatment abroad in places such as Singapore. Meanwhile, in the more developed economies, long waiting times for some treatments in public systems lead affluent consumers to access cheaper medical care abroad, in places such as Thailand.

With fast-changing corridors and spending patterns, a satisfying customer journey needs agility. Businesses report strong returns from optimising checkout processes, good design practices, and seamless checkout processes to reduce cart abandonment². Modern technology also offers new ways to boost payment efficiency and reduce revenue leakage.

Asia Pacific’s strong fundamentals

The fundamentals of the Asia Pacific travel industry are strong: a rising middle class, smaller households, and diverse destinations. Growth for the industry, however, does not come without challenges such as disruptions to trade, evolving consumer preferences, and financial pressure on households.

With Visa’s global payments network, granular data, and bank of travel experts and consultants, we are ready to navigate these changing travel currents with you.

*Note: unless otherwise specified, all data on traveller numbers are from the Visa International Travel database and those on spending amounts are from VisaNet

_________________________________________________

¹ Oxford Economics, 2025

² Visa Centre of Excellence for Travel in Asia Pacific, 2025