Remittances, or the sending and receiving of money across national borders, have always been a feature of Asia Pacific. The mobile and footloose nature of Asia Pacific populations make remittances vital to the way people live, study, work, and maintain relationships. In fact, five of the world’s top ten countries by remittance inflows¹ come from Asia Pacific, with India at the top, followed by Mainland China, the Philippines, Pakistan, and Bangladesh.

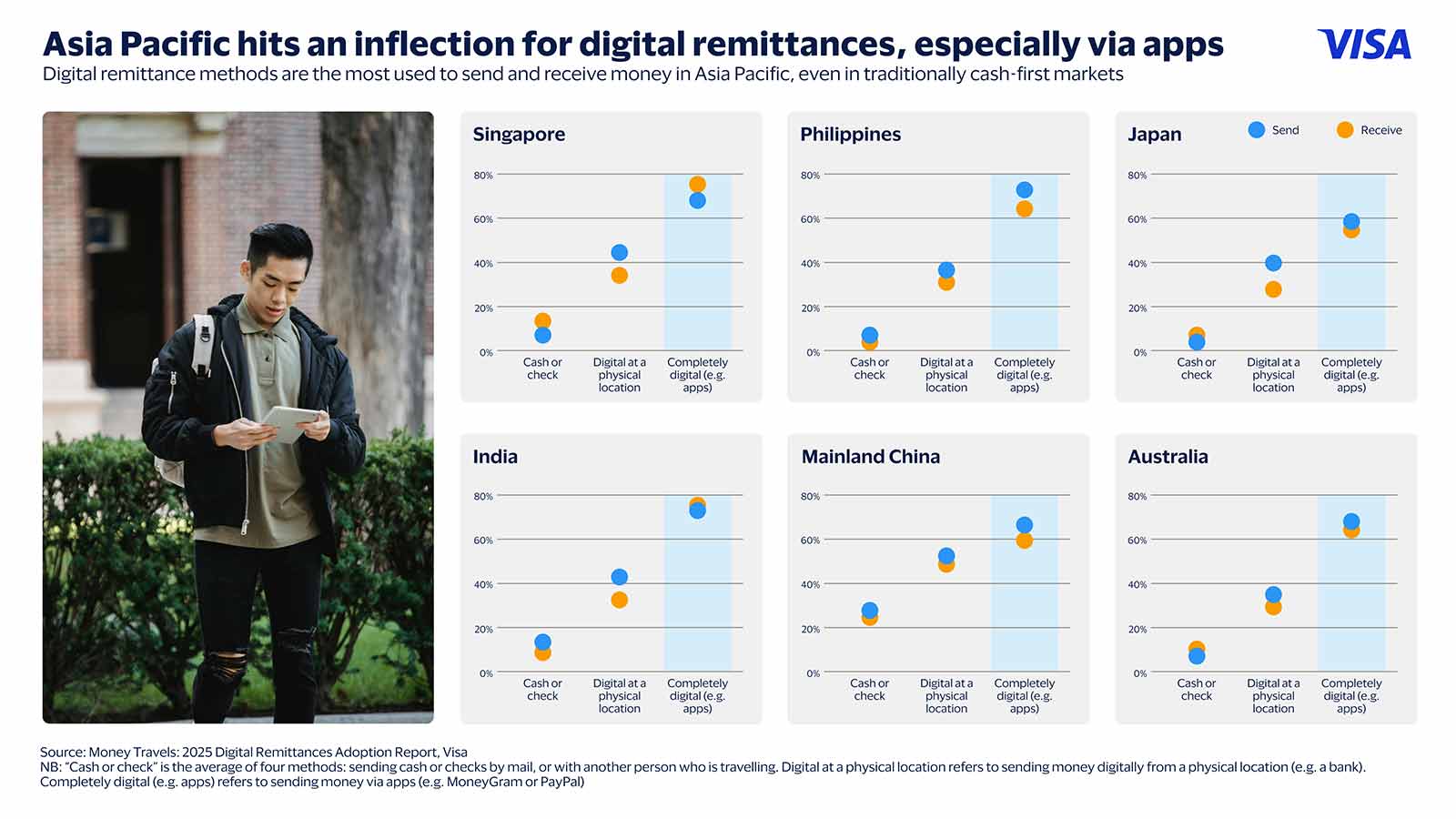

With remittances growing by 4.6% globally to US$905 billion in 2024², how communities in Asia Pacific perceive and use remittances is undergoing a clear digital inflection. According to Visa’s Money Travels: 2025 Digital Remittances Adoption Report, digital apps are now the most widely used way to send and receiving money among over 25,000 respondents across six surveyed markets in Asia Pacific: Australia, India, Japan, Mainland China, the Philippines, Singapore, ahead of cash-and-check and other forms of digital remittances.

Security is key to this digital shift. In all six markets surveyed, respondents do not only think digital remittances are faster and more convenient – they are also seen to be the safer way to send and receive money.

Once seen as an alternative to cash remittance, digital remittances are set to drive the growth of remittances in Asia Pacific. Uncover more insights from the Money Travels report by Visa below.

Remittances reach digital inflection, especially for digital apps

What is crucial is that digital apps were the most used remittance method even in typically cash-first markets. For example, in Japan, 58 percent of respondents said they use a digital app to send money to another country and 56 percent used a digital app to receive money from another country.

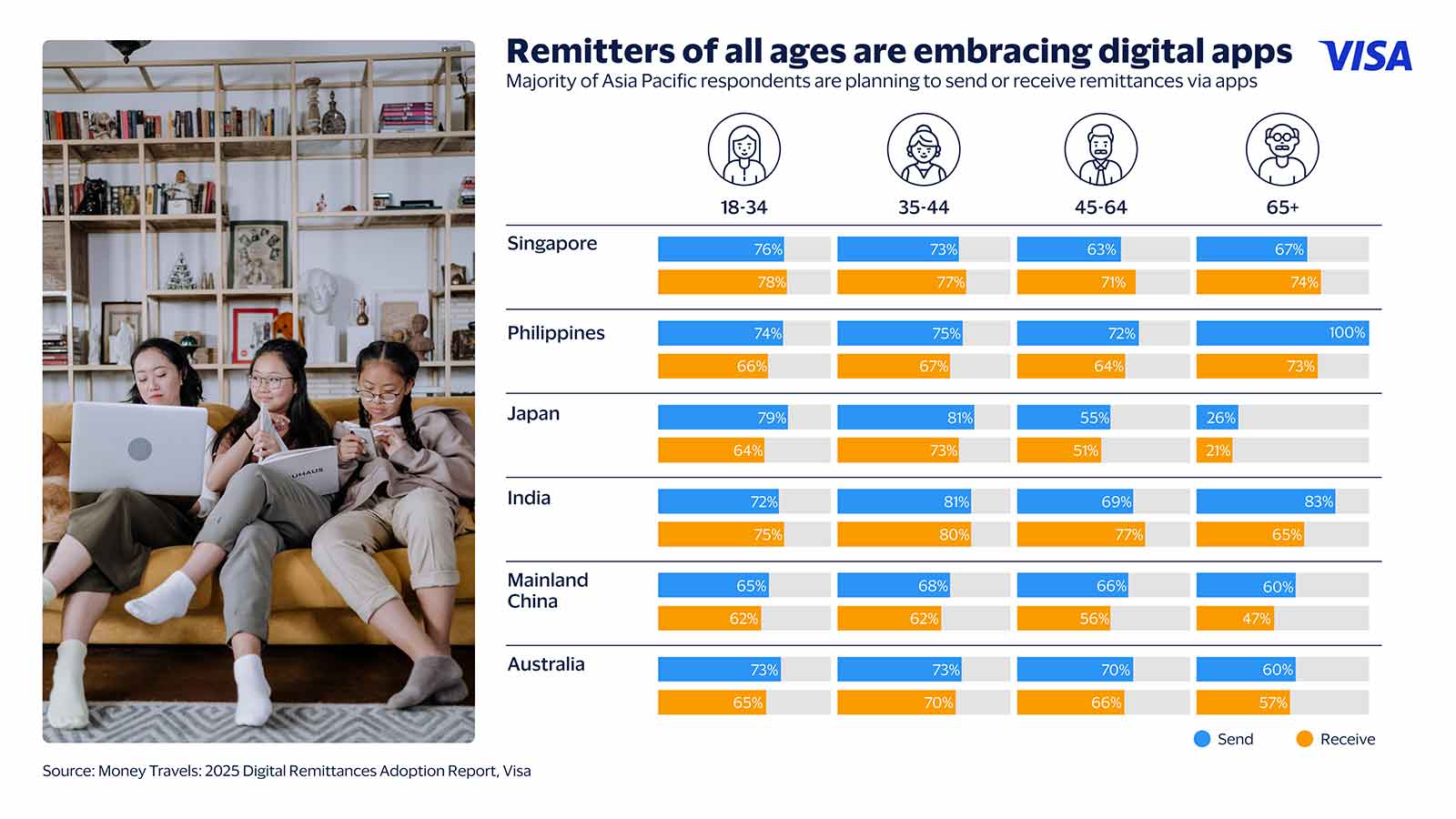

Unsurprisingly, younger respondents are among the most digitally-savvy when it comes to remittances. In Australia and Singapore, respondents aged 18 to 34 used digital apps the most to send and receive remittances, while in Japan and Mainland China, respondents aged 35 to 44 were the heaviest users of digital apps.

Remittances are embedded in Asia Pacific’s communities

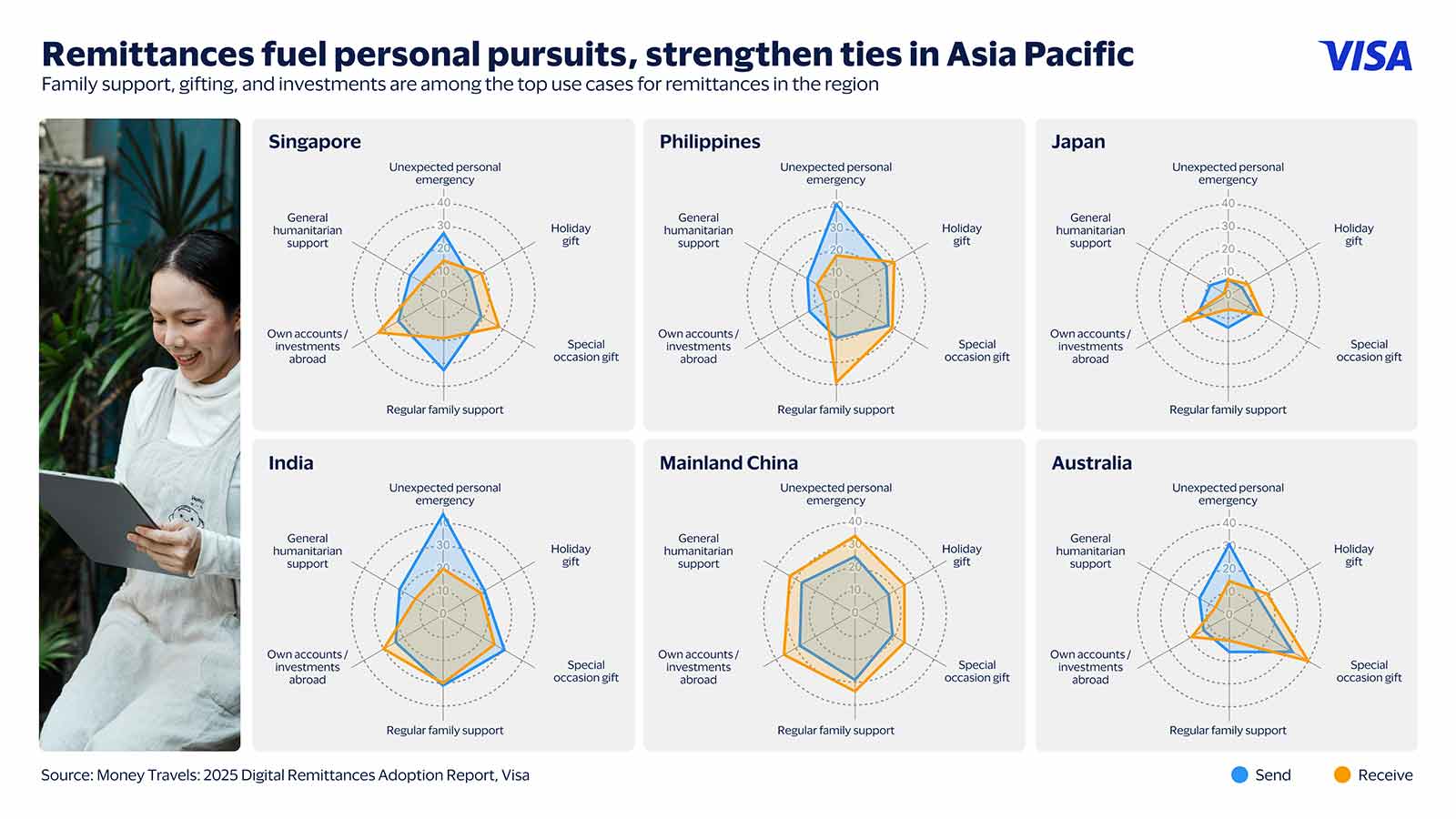

This thread has continued in 2025. Unexpected personal emergencies, such as accidents or medical bills of family members back home, was the top reason for sending remittances in the Philippines (41%), India (44%), and Australia (31%). This was followed by regular family support in the form of allowances or supporting household bills at home by respondents in the other three markets (29% in China, 14% in Japan, 33% in Singapore).

This reflects the role of remittances in maintaining family support networks, especially in markets where people spend their working ages abroad like India, Mainland China, and the Philippines. Beyond familial support, gifts for special occasions and holidays continue to be a significant reason why remitters are sending money overseas.

The receiving of remittances is largely driven by personal pursuits, such as remitting money abroad to the younger generation pursuing further education overseas who receive money to pay curriculum bills, or remitters transferring funds to their overseas-based banking or investment accounts. This is the top reason for receiving remittances in four out of the six Asia Pacific markets, namely China (36%), Singapore (33%), Japan (23%), and India (30%).

The future of remittances in Asia Pacific

As Asia Pacific becomes more open and its populations more mobile and connected to the rest of the world, remittances are set to play an enduring role in keeping people, families, and communities connected.

At the same time, the region's advancing digital infrastructure is set to deliver safer, faster, and more convenient digital remittances that enable almost anyone to send and receive money across borders with peace of mind. Connecting over 11 billion payment endpoints in over 195 countries and territories and supporting more than 150 currencies, Visa Direct allows our partners and their customers to digital remittances with unprecedented speed and security.

_________________________________________________

1 Global remittance rankings 2025: India leads the world with $125 billion sent home by expats