81 per cent of leading corporations in Singapore do not have 60-day cash flow visibility: Visa study

01/19/2015

Global research commissioned by Visa shows leading corporations suffer from lack of visibility and predictability in their cash flow positions

Singapore - Some of the leading companies in the world lack efficient processes, systems and tools to deliver real-time visibility and predictability in their cash situation, according to a recent survey of CFOs and corporate treasurers. This is despite most organizations clearly identifying cash flow as the single most important determinant of business profitability1.

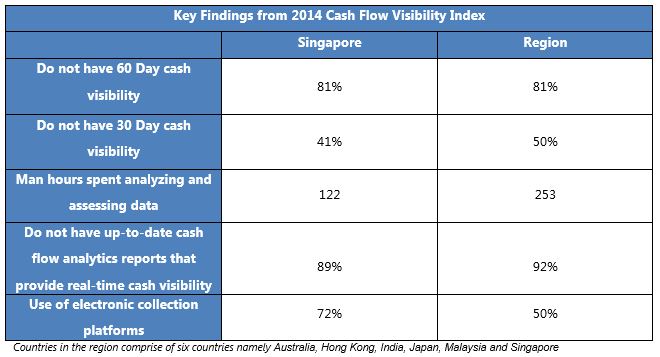

The 2014 Cash Flow Visibility Index study2 (the “Study”) released by Visa today highlights cash visibility processes and activities of leading companies across ten countries around the world. Key findings show that 81 per cent of companies in Singapore do not have 60-day visibility of their cash obligations and 41 per cent of them do not have a 30-day visibility. In the region, 81 per cent of the companies do not have 60-day cash flow visibility and 50 per cent of them do not have 30-day visibility. Given the lack of the right processes, systems and tools, these companies require time to manually work on and generate cash flow and analysis reports. Hence, these reports may be at least 10 days old. The study revealed that, in fact, 89 per cent of leading companies in Singapore do not have access to analytic reports that provide real-time visibility.

“The findings from the study highlight that businesses are in need of solutions that will greatly enhance their cash management processes. Real-time visibility and predictability is a must-have for all CFOs and Treasurers so that they can make accurate decisions on reinvestments or expansion of their businesses, both leading to better profitability for their companies,” said Olivia Leong, Head of Commercial and Prepaid Payment Solutions, Visa Asia Pacific.

Another key finding from the study showed that regional organizations spend up to 253 man hours per week manually entering data and preparing cash assessment and analysis reports because of the lack of appropriate tools and systems. Singapore companies fare better, but still require more than 120 man hours a week to perform these tasks.

The study also highlighted the low adoption of electronic collection and payable platforms in many businesses. Some 72 per cent of companies in Singapore use electronic collection platforms to manage their revenue but only 21 per cent of revenues are managed electronically by a collection platform. The lack of real-time digitized data of receivables and payables means that businesses are unable to predict their future cash obligations accurately.

CEO of East & Partners Asia, Lachlan Colquhoun, who conducted the study for Visa highlighted, ”Large and complex organizations, that have enterprise systems appear to have an overlap between data maintained on their systems and on spreadsheets. This overlap indicates that duplication of data persists or that the same duplicated information is inadequate for eventual use. We also see companies in sophisticated markets such as Singapore that have a higher proportion of data available on their enterprise systems having a higher degree of overlap.”

“Real-time digitized data from a single, reliable and clean source is critical to achieving profitability objectives for businesses. Our discussions with finance professionals suggest that their challenges in obtaining such data may arise from a lack of optimization on existing systems. Finance professionals also hesitate to source for new solutions due to the perceived time and resource investment that they believe is required. However, easy-to-deploy and cost effective solutions are available to companies, and they can start by changing the way businesses pay and get paid. A 16-digit account plays a pivotal role in this process change,” Leong added.

Visa has a significant focus on digitization of B2B payments. In collaboration with established global technology solutions providers such as cloudBuy, Kofax, Invapay and Spendvision, Visa is able to give businesses a comprehensive and effective approach to managing their financial processes and address the challenges of visibility and predictability. For example, Invapay helps to facilitate buyer initiated electronic payments by onboarding suppliers.

1 Atradius Payments Barometer 2013

2 The “2014 Cash Flow Visibility Index” study was done with CFOs/Treasurers of 811 leading corporations in ten countries by East & Partners, an independent specialist business banking market research and analysis firm

About Visa

Visa is a global payments technology company that connects consumers, businesses, financial institutions, and governments in more than 200 countries and territories to fast, secure and reliable electronic payments. We operate one of the world’s most advanced processing networks — VisaNet — that is capable of handling more than 47,000 transaction messages a second, with fraud protection for consumers and assured payment for merchants. Visa is not a bank and does not issue cards, extend credit or set rates and fees for consumers. Visa’s innovations, however, enable its financial institution customers to offer consumers more choices: pay now with debit, ahead of time with prepaid or later with credit products. For more information, visit https://usa.visa.com/, visacorporate.tumblr.com and @VisaNews.