Contactless payments, experiential travel top Asia Pacific travel needs

Less than six months since the World Health Organization (WHO) declared an end to Covid-19 as a global health emergency, international leisure travel is close to seeing a full recovery to pre-pandemic levels, with international tourism reaching 84 percent of pre-pandemic levels from January to July 2023.

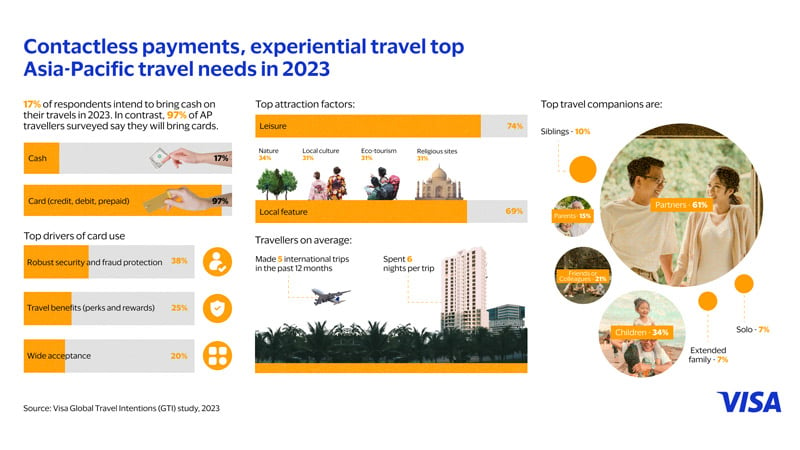

Visa’s latest Global Travel Intentions (GTI) survey shows that Asia Pacific travellers are contributing to the global recovery. The survey found that on average, travellers had five international trips in the past 12 months and are spending an average of 6 nights per trip.

The survey also found two factors to be driving travel recovery in Asia Pacific: the shift to contactless travel and growing demand for experiential travel.

Contactless is king

As travellers take to the skies, seas, and roads in greater numbers, cash is increasingly left behind in favour of contactless and digital payments. According to the GTI survey, 97 percent say they will bring cards (credit, debit, or prepaid) on their trips, with just 17 percent saying they intend to bring destination currencies. This is a steep decline in cash preference from the previous GTI survey in 2020, where 79 percent said they intend to bring cash on their travels.

According to the GTI survey, travellers in Asia Pacific are also spending more with an average of $2,525 per trip versus $1,708 in 2020. Together with the increased familiarity with contactless payments forged during the pandemic, merchants and destinations can unlock this demand by meeting new payment preferences.

More merchants around the world today accept card and digital payments, creating more convenience for travellers and locals alike. Sightseeing in London? You can use your locally issued contactless card to pay for your hotel, dining and shopping expenses, and for public transport. The same is true for those visiting Asia-Pacific cities like Singapore or Sydney.

Transport operators are also getting on board. For example, Japanese train operators are introducing tap-to-pay gates to make inter-city travel more convenient for foreign visitors – making it a breeze for foreign investors to move around without struggling with language barriers. Auckland Transport will also roll out contactless payment options, including Visa Paywave, across the city’s buses, trains, and ferries in coming months.will also roll out contactless payment options, including Visa Paywave, across the city’s buses, trains, and ferries in coming months.

These shifts are also reflected in the GTI survey. 38 percent of travellers said they prefer cards because of robust security and fraud protection features, followed by travel benefits such as perks and rewards (25%), and their wide acceptance (20%). Other reasons for preference included having an online app they can use, signalling a growing consumer demand for physical cards to be integrated with their mobile devices.

The allure of experiential travel

For Asia-Pacific travellers, it’s not just about how they pay, but also the experiences they pay for. On their future travel intentions, 69 percent are looking for local features in their next destinations. Within this, natural attractions, local culture and history, religious sites and landmarks, and sustainability and eco-tourism are major drivers of travel. In other words, travellers want immersive and green travel experiences.

Iceland, known for its stunning natural beauty, has welcomed 13 percent more international tourists, and garnered a quarter more earnings from tourism, from January to July 2023 compared to the same period in 2019. Rural Japan also saw a sharp rise in travellers seeking to experience the hot springs in Yamagata and Gunma, visit ancient shrines and castles, or immerse in centuries-old traditions. Cruise operators are also offering routes to private islands for those tired of crowded beaches and tourist traps.

Wherever travellers go, payments systems must follow, even off the beaten track. Local merchants and venues can greatly benefit from understanding their diverse visitors and offer the right mix of payment options. Visa is helping them do so – we work with governments and destinations around the world to accept card and digital payments, while Visa’s range of bank and ecosystem partners make it easy for Asia Pacific travellers to use card and digital payments abroad.

At the same time, merchants should also be paying attention to who is traveling. The GTI survey also showed that travellers in Asia Pacific tend to travel with family members; such as partners (61%), children (34%), parents (15%), and siblings (10%). Destinations can capitalise by offering experiences the whole family can enjoy.

The way people in Asia Pacific travel has evolved since the pandemic, with new payment habits here to stay. As more travellers opt for contactless payments and experiential travel, local governments, destinations, and merchants should embrace these changes and uncover new areas of growth in the coming years.

The Visa Global Travel Intentions Study 2023 was conducted by 4SIGHT Research & Analytics in April to June 2023 and surveyed 15,467 respondents across Australia, Hong Kong, India, Indonesia, Japan, Mainland China, Malaysia, New Zealand, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam. Spanning over a decade, the biennial GTI survey sheds light on travel and payment behaviours while capturing emerging trends in the travel landscape.

Contact Visa to access the full Global Travel Intentions report and unlock more insights on travel in Asia Pacific.