Delivering more value to the Asia Pacific digital wallets market

By collaborating with innovative digital wallet partners, Visa Direct is giving individuals, businesses, and clients more options for digital transactions.

The last five years have seen digital wallets rapidly become a fixture of the Asia Pacific payments ecosystem. The pandemic has played a key role here – as online spending soared during pandemic-induced lockdowns, wallet platforms saw a swift uptake in new users. They were drawn to the technology’s sheer ease of use, enabling quicker transactions in online shopping, gaming, food delivery, subscriptions to TV streaming services and more.

As a payments tool, wallets can be deployed via a smartphone as well as a laptop or tablet and in a mobile-first region such as Asia Pacific with its high levels of smartphone penetration that makes them extremely accessible, adoption is accelerating with no signs of slowing.

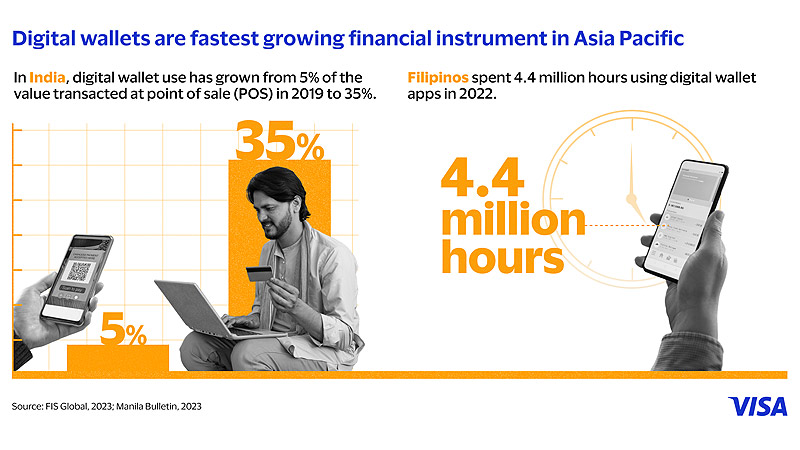

Digital wallets are now the fastest growing financial instrument for individuals and small businesses across the region. In India, for example, digital wallet use has grown from 5 per cent of the value transacted at point of sale (POS) in 2019 to 35 per cent in 2022. A further 88 per cent rise in value is expected by 2026. It’s a similar story in Asia Pacific economies such as the Philippines. According to the Manila Bulletin, over 58 million Filipinos spent 4.4 million hours using digital wallet apps in 2022.

But what’s behind this boom – what features of digital wallets do consumers most value? What do banks, merchants, financial technology companies, and other payment services providers need to know now about the trend to help them improve their service offerings?

Unpacking the benefits of digital wallets

Consumers are not required to have a credit card or bank account to load or receive funds directly to their digital wallet. That makes wallets a highly convenient payment option for the banked as well as the unbanked, who may use this option as their primary financial instrument. Deepan Dagur, Head of Visa Direct, Asia Pacific adds, “The prevalence of digital wallets has made P2P remittances possible for the many people in Asia-Pacific who don’t have a bank account, further contributing to the remittance flows.”

Wallet technology also makes it more cost-effective for consumers to make frequent transactions of smaller amounts – this way, they pay less fees. That becomes especially relevant in a cross-border transfer context. In parallel, consumers and businesses in the region are also leaning towards wallet technology for remittances, a payment type that payments services providers have often struggled to make efficient and cost-effective. Challenges here have included legacy banking systems and high regulatory scrutiny.

Pankaj Sharma, Global Lead for Visa Direct Wallet, describes how digital wallets can remove friction and deliver more flexibility in such a scenario. “Let’s say a young professional in London wants to send remittances home to his mother in Manila, who has access to a digital wallet. The process is simple - the son can log on to his banking app to indicate the sum to send and choose to push the amount to an account, a card, or a wallet. When he chooses ‘wallet’, the bank will offer a range of wallet platform options. The funds will then be credited quickly into the mother’s wallet.”

Tapping on the advantages of a powerful network

Visa Direct aims to provide a single point of access to billions of endpoints, helping transform global money movement by facilitating the delivery of funds to eligible cards, bank accounts and wallets around the world. The company wants to operate as a single point of access for initiating any transaction type.

Entering into strategic collaboration agreements with wallet partners globally and in Asia Pacific can not only help address the painpoints of traditional money movement but also address the challenge of geographical reach.

Visa Direct’s collaboration with innovative global payments company Thunes is a case in point. Through this partnership, individuals and small businesses can move money internationally to 78 digital wallet providers, reaching 1.5 billion digital wallets across 44 countries and territories. Similarly, an agreement with global payments infrastructure company TerraPay is enabling Visa to deliver faster, more seamless remittances for individuals, along with payouts for small and medium-sized businesses across 108 countries and territories.

2023 saw Visa forge an exciting new partnership with Tencent Financial Technology to further this approach. This partnership will enable Weixin users to receive inbound remittance in their digital wallets and also extend the Visa Direct network to reach more than one billion Weixin users in Mainland China, one of the world’s largest inbound remittance markets.

On the growing momentum of digital wallets and how Visa is working with its global network of partners, Dagur says, “The new digital habits we are seeing today means many prefer the ease of receiving money straight to their digital wallet, credit card or debit card. Customers no longer want to travel to a bank branch and fill out a form to make a payment. Payment service providers need to have the reach to different endpoint options beyond just bank accounts.”

Fueling growth in the Asia Pacific payments ecosystem

Forging new collaborations with innovative wallet partners is just one example of how Visa is working to ensure consumers, businesses, and clients in Asia Pacific can move money quickly, easily and securely to potentially billions of endpoints.

“We’re always seeking opportunities to further drive the digitisation of payments while bringing stronger network capabilities to new and existing clients,” says Sharma. ““By facilitating such transactions, we’re helping our partners deliver greater choice to their customers and working together, we believe we can help bring about a new era for inclusive and accessible global payments.”

Find out more about Visa Direct here.