"Free gift" or scam? Learn to spot fraudster-speak

Scammers are using more and more sophisticated tactics to steal our confidential information and our money. Over a period of 12 months, Visa blocked USD7.2 billion worth of attempted fraudulent payments across 122 million transactions, stopping fraudsters in their tracks. 1

Today it’s not nearly so obvious you’re dealing with a criminal, and that applies to the language they use in their communications.

We’re not as savvy as we think we are

Scams are becoming so familiar that Visa commissioned a global report — “Fraudulese: The Language of Fraud” — and the results are a tad alarming.

Almost half of the people we surveyed believe they are super knowledgeable when it comes to recognising scams. But nearly 75% of people revealed they would typically respond to terms or phrases scammers often use in emails, text messages or social media messages.

Even more concerning is this: the people who describe themselves as “very” or “extremely” knowledgeable in recognising scams are more likely than the less confident people to act on at least one type of common scam message. Especially when it’s related to an opportunity for easy money.

What kind of language should you look out for?

Words and phrases like “free gift/gift card,” “exclusive deal,” “you have been selected,” “now available,” “giveaway” and “you are a winner” are used to reel people in — even those who think they’re highly savvy.

It’s great to be confident, but not at the expense of your wallet and private details. One way to reduce your risk of being scammed, is learning to spot “fraudulese”: those words and phrases frequently used in real-life scams. Whether you’re in Australia, Japan or Singapore, look out for some recurring themes.

Unexpected money

You’ve won a cash prize when you never entered the draw in the first place: immediate red flag!

Criminals play with your emotions by pushing the excitement factor and offering too-good-to-be-true prizes. For example, “Guess what?? You have been approved for a lump sum payout of $648,525.38 … CONGRATULATIONS!!!”

They ask you not to tell anyone, for example, “I have something very good and confidential to share with you”. Naturally, they don’t want you seeking the advice of a friend or family member. Sometimes they say the offer will be voided if you tell anyone.

Scammers make it sound urgent and put the pressure on, hoping you will react quickly without thinking it through. “Act now! Remember, all prize money must be claimed no later than x date — BE WARNED!”

Whatever region you’re in, don’t be taken in by an extended family member reaching out via social media, telling you you’ve won a big cash prize or that your name is “on a list”. Chances are their account has been hacked by a scammer.

In some cases, the criminal will contact you over the phone or via SMS and proceed to impersonate the extended family member.

Glamorous giveaways/prizes

In one instance, an Australian victim was researching holidays when a pop-up offered her an irresistible travel prize. It said she would need to call the number listed “within three minutes” to claim her prize. Dead giveaway!

All over the world, fraudsters have come up with versions of fake giveaways promoted through social media ads. One example describes an “amazing giveaway” of two luxury vehicles: “For the FIRST time in history”. Ads are often well written and polished, with fake comments making it feel all the more believable.

Investment opportunities

With investment fraud, look out for phrases such as: “it’s a limited offer” or “don’t miss this opportunity”.

In Japan and elsewhere, cold calling is a problem. Here the scammer pretends to be a brokerage or asset management firm and approaches people via non-face-to-face channels, including email, to solicit investment in securities or financial products.

Urgent requests for fund transfers are a sure sign, as are claims that the share price of a certain “high quality” company will soon “increase significantly”.

When a stranger wants to be friends on social networking sites then claims they’re a stockbroker, bank or financial company employee, be on high alert. Especially if they offer incredible investment opportunities with unreasonably “high returns” and little-to-no risk.

In Singapore, scammers have even pretended to be representatives of the nation’s sovereign wealth fund (GIC), on group chats. Victims are invited to join group chats where they’re offered lucrative investment packages.

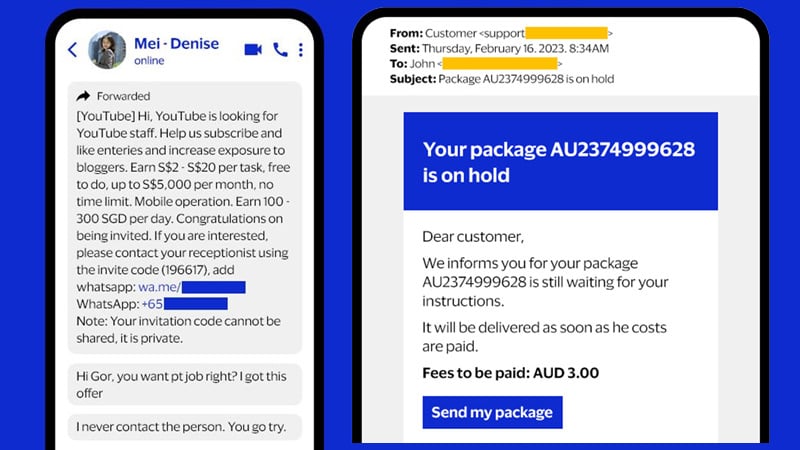

Dream job offers

Finally, wherever you’re based, there are people who try to take your money or your personal information (or both) through fraudulent job ads, social posts, emails or direct messages. Be especially wary of “work from home” jobs that “guarantee” a ridiculously lucrative day rate for easy work.

If you’re asked to pay upfront for a background check, job training, or starter kit of materials and told you’ll be reimbursed in your first paycheck, and they ask you to transfer via money order, wire transfer, pre-loaded card or electronic currency — run, fast, in the other direction. You’ll never be reimbursed, and you probably won’t be able to recover any money transferred.

To keep your financial information and your money safe, take a few extra moments to analyse the language before acting on an offer from a stranger. If you have even the tiniest suspicion about a communication, however convincingly it’s worded, do not click or reply. Instead, “block” or “report” the contact.

Also make sure you’re up to speed with warnings from your government on scams. Visa is constantly updating our network security to ensure your data is safe.

Key takeaways

- However confident you feel, you still could end up a scam victim

- If you didn’t enter a competition for a fabulous prize, you haven’t won it

- Never feel pressured to act quickly

- “High return, no-risk” investments or amazing job offers are probably too good to be true

- If in doubt, block/report – or at least do some research to see if it’s legitimate

________________________________________

1 For the period of November 2021 - November 2022